Prospects for Xiamen property market bright for IOI Properties

IOI Properties Group Bhd (Aug 30, RM2.52)

Maintain neutral with an unchanged target price (TP) of RM2.65: IOI Properties Group Bhd announced that it had successfully tendered for a piece of leasehold land of about 6.2 acres (2.51ha) in Xiamen, China, for a total sum of 2.324 billion yuan (RM1.4 billion). This is the third foray of IOI Properties into Xiamen. Note that IOI Properties made its first foray into Xiamen in 2011 with the acquisition of 7.7 acres of land followed by acquisition of 44 acres of land in 2012. The land tender is expected to be completed by the third quarter of 2016.

The land is strategically located within the new Xiang An Central Business District, which is proposed to be a new integrated eco-city. It is connected to the Xiang An undersea tunnel, Shen Hai Expressway and Xiang An Highway. The land is estimated to be 40km away from IOI Properties’ IOI Palm City in Jimei New City. The purchase consideration of 2.324 billion yuan or 8,605 yuan per sq ft (psf) for the land is higher than its purchase consideration of 631 yuan psf for the Jimei land back in September 2012, which could be attributed to the strategic location of the land.

We are neutral on the land acquisition as the project’s gross development value (GDV) is yet to be determined. We gather that the land is targeted for mainly residential projects, while the timeline of property launches is yet to be provided. Prospects for the property market in Xiamen remains bright, judging from the strong take-up rate (more than 90%) of IOI Properties’ IOI Palm City project in the fourth quarter ended June 30, 2016 (4QFY16). We see that funding is not an issue for IOI Properties considering its low net gearing of 0.14 times as at end-FY16. We estimate net gearing of IOI Properties to rise to 0.23 times, assuming 50% cash funds and the remaining 50% of funds from borrowings.

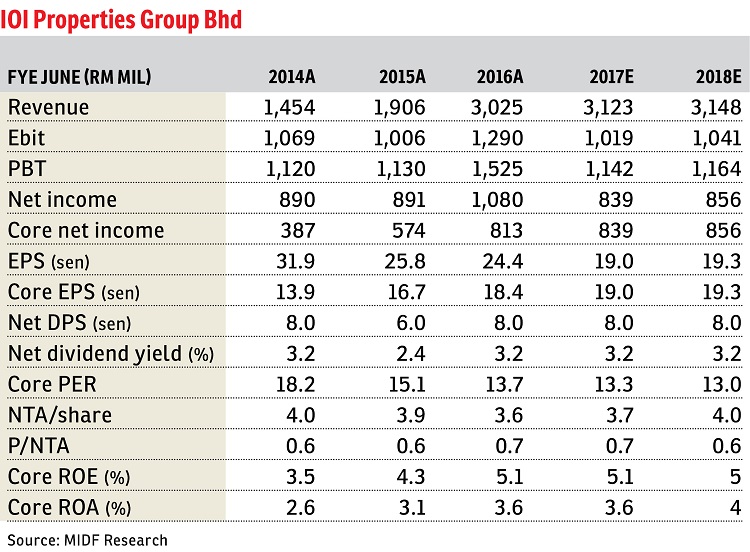

We maintain our earnings forecasts for FY17 and FY18, pending further details from management on the timeline of property launches. Our TP is also unchanged at RM2.65, pending information on potential GDV of the projects. Our TP is based on a 40% discount to fully diluted revised net asset value. — MIDF Research, Aug 30

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Sept 1, 2016. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.