KUALA LUMPUR (April 27): Terengganu’s property market saw the value and volume of its transactions rise by 18.3% and 2% year-on-year respectively, according to the recently published National Property Information Centre (Napic) “Property Market Report 2014”.

It recorded 20,319 transactions worth RM2.46 billion, up from 19,919 transactions worth RM2.08 billion in 2013.

The residential segment spearheaded Terengganu’s market performance, with 62.8% of total market share, followed by the agricultural (17.9%), development (16.3%), commercial (2.7%) and industrial (0.2%) segments.

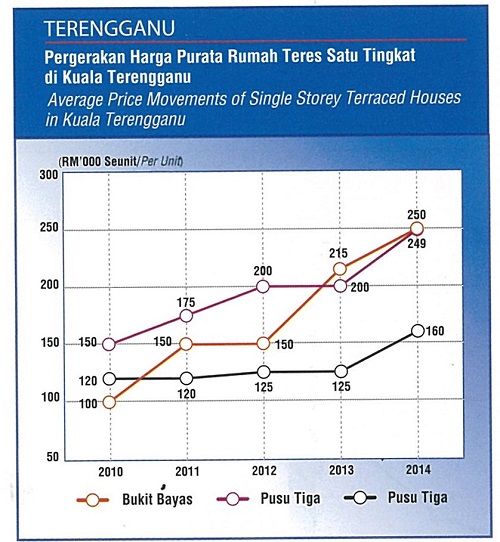

“Prices of residential property were generally stable with an upward trend noted in choice locations,” says Napic.

The report highlights that average values of 1-storey terraced houses in Taman Adis Indah grew by 19.7% due to their proximity to Green Acres Gold Resort and the proposed Kuala Terengganu Bypass, while housing developments located near higher learning institutions and the East Coast Highway interchange also recorded gains.

“In Kemaman, high demand for schemes located in flood-free areas pushed up prices. Prices of detached plots firmed up in Kuala Terengganu, particularly those in areas near the new state administrative centre in Bandar Baru Bukit Besar,” says Napic in the report.

The All House Price Index for the state stood at 260.8 points at 4Q2014, up from 245.7 points from previously.

The primary market saw more new launches, at 1,536 units, while sales performance was moderate at 34.4%, up from 19.1% in 2013. Single-storey terraced houses comprised 40% of total new launches.

The residential rental market was generally stable, and rents for 1-storey low-cost terraced houses in Kuala Terengganu showed a significant increase of between 13.3% and 33.3% to command higher monthly rentals of between RM250 and RM500. Proximity to institutions of higher learning contributed to rental growth.

The number of residential overhang units in the state was recorded at 11, a 65% decrease in volume from last year, and was worth RM1.76 million (down 79.3%). There were 696 units (up 0.3%) of unsold units under construction and 248 unsold units (down 35.1%) of not yet constructed.

The residential segment recorded fewer completions (2,440 units) and starts (3,417 units), a decline of 34% and 5.4% respectively. In contrast, new-planned supply was up by 73.8%.

According to CH Williams Talhar & Wong (Kuala Terengganu) Sdn Bhd director Mohd Kamal bin Mohamed, the overall property market in Terengganu is stable with landed properties being in higher demand compared with stratified properties.

“Prices for residential properties have increased over the past few years. I foresee the property market this year to be rather challenging, particularly for properties priced over RM400,000, many of which are one-storey detached houses,” says Mohd Kamal. He adds that properties under RM400,000 still enjoy stable demand. These comprise terraced and semi-detached houses.

Market activity for the shops segment was sluggish, with limited transactions. The rental market for ground-floor shops, shopping complexes and purpose-built offices was generally stable with little upward movement from rental renewals and new tenancies. Starts dipped by 43.3% while completions and new planned supply rose by 85.8% and 14.5% respectively.

In the leisure segment, hotels rated between three and five stars had an overall occupancy rate of 58.1%, higher than 56.9% in 2013.

In terms of overhang units, the shops segment recorded 14 overhang units worth RM11.06 million compared with none in 2013. Unsold units under construction decreased 38.2% to 47 units, while the number of unsold units not yet constructed was recorded at 28. The industrial segment recorded no overhang and unsold units.

Overall occupancy for shopping complexes declined from 76.7% to 76% in 2014. New construction recorded three starts or 43,559 sq m of retail space, and new planned supply of 24,708 sq m. Four complexes were recorded as incoming supply at end-2014, and one complex as new planned supply. Existing supply remained at 35 units.

Overall occupancy for the office segment remained firm at 98.4% , up from 98.1% previously. One new completion of 1,220 sq m was recorded under this segment. New planned supply was 40,497 sq m, while incoming supply was 13,803 sq m, and existing supply stood at 117 units of purpose-built office blocks of 329,554 sq m.

The report expects 2015 to remain positive, with ongoing developments such as the Kuala Terengganu City Centre and the construction of a new bridge connecting the north and south sections of Heritage Waterfront City, which is due for completion next year.

(Source: Napic)