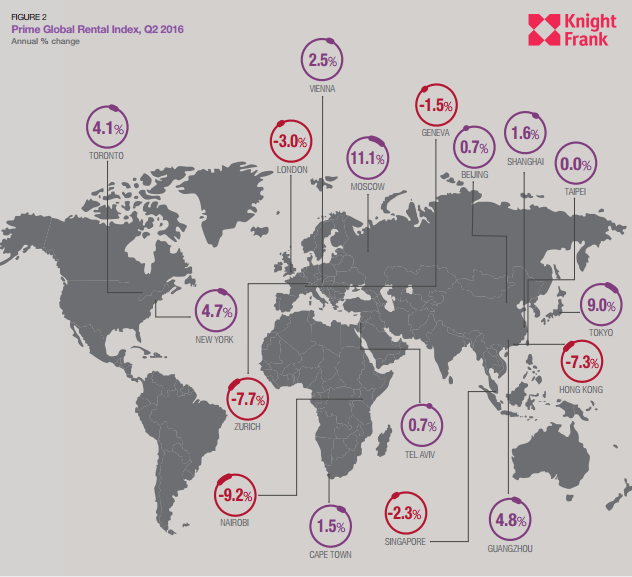

PETALING JAYA (Oct 5): Moscow recorded strong growth in its prime rental, rising by 11.1% year-on-year, holding the top spot in Knight Frank’s Prime Global Rental Index 2Q2016.

“Sizeable infrastructure investments in Moscow combined with a marked slowdown in the contraction of the national economy and substantial gains in oil price over the last quarter have underpinned rental growth,” said the international property consultancy firm.

Moscow is followed by Tokyo and Guangzhou where prime rentals have increased by 9% and 4.8% respectively in the year to June 2016.

Meanwhile, Nairobi continues to be the weakest performing market with prime rents falling by 9.2% annually.

Since the third quarter of 2011, Nairobi has recorded annual prime growth of 9.7% on average and the market is now looking to rebalance, said Knight Frank.

Meanwhile, the slowdown in the prime central London rental market continues with rents falling by 3% in the 12 months to June 2016 with higher stock levels and uncertainty in financial markets contributing to the fall, added the firm.

Overall, Knight Frank’s Prime Global Rental Index has increased by 0.5% overall in the year to June 2016, the first time it has recorded positive annual growth in the last year.

“The gap between the top and bottom ranking cities has risen considerably. The strongest performing city (Moscow) and the weakest performing city (Nairobi) are separated by 20.3%. A year earlier the comparable figure was 15.1%,” said its senior research analyst Taimur Khan.

North America is the strongest performing world region for the third consecutive quarter, with prime rents rising by 4.4% per annum on average while Africa recorded the weakest performance with prime rents falling by 3.8% on average.

Of the 17 cities tracked by the index, 10 saw prime rents rise in the last 12 months to June 2016.

“While uncertainty caused by Brexit and the US presidential election still lingers, we are starting to see a more positive global economic landscape develop.

“Sustained and positive economic data from the US growth in emerging markets led by easier access to credit markets and increased demand from China for commodities suggest a positive outlook for the remainder of 2016.

“For prime rental markets, these factors are likely to stimulate demand from corporate tenants,” said Khan.

Try out one of our super tools, the rental yield calculator, here.

TOP PICKS BY EDGEPROP

Canal Gardens, Kota Kemuning

Kota Kemuning, Selangor

Cheria Residences, Tropicana Aman

Telok Panglima Garang, Selangor

Pangsapuri Seroja Bukit Jelutong

Shah Alam, Selangor

Suria Industrial Park (SIP)

Sepang, Selangor

Suria Industrial Park (SIP)

Sepang, Selangor

Taman Suria Warisan @ Kota Warisan

Sepang, Selangor