Protect your rights when buying commercial properties

We used to be able to make a clear distinction between commercial and residential properties, but nowadays, we have homes with commercial titles and offices with residential elements, which can sometimes throw you off as to what exactly you are buying.

Besides office units, shophouses and retail units in shopping malls, there are also serviced suites managed by hotel operators offering short- and long-term rentals. These properties clearly market themselves as commercial properties but there are those that are less clear-cut.

Bedazzled by the stylish showrooms, many jump on the bandwagon to purchase Small-offices Versatile-offices (SoVos), Small-offices Flexible-offices (SoFos), Small-offices Lifestyle-offices (SoLos) as well as designer suites and other ambiguous names. But as they say, a rose by any other name will smell as sweet, because these are all basically commercial office units, some with of residential elements.

Protection

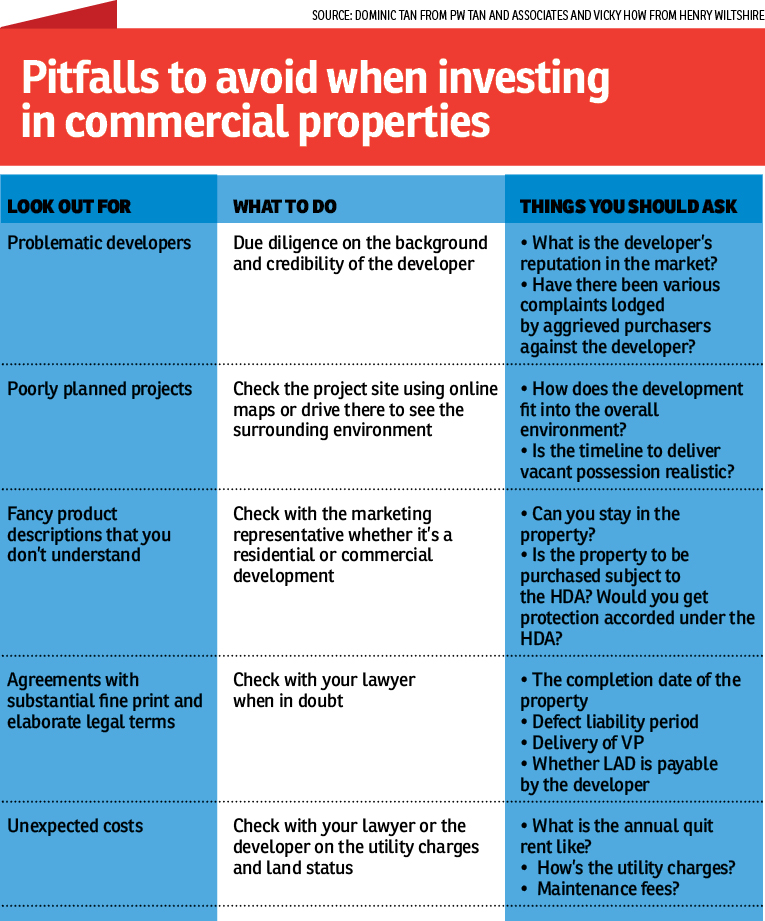

Founder of PW Tan & Associates Dominic Tan says owners of commercial-titled properties do not get the kind of protection that residential-titled property owners do.

“All the protection offered by the Housing Development (Control and Licensing) Act 1966 (HDA) for residential property buyers will not apply to commercial property owners. The terms for commercial property transactions are purely based on the contractual agreement between the buyer and seller,” he tells TheEdgeProperty.com.

National House Buyers Association (HBA) secretary-general Chang Kim Loong concurs that the many names used to market commercial products have confused property buyers, as the artist impressions used in marketing brochures may look like a residential project and you may not know it is actually a commercial project unless you read the small print.

“If you have little knowledge of what to look out for, it would be unlikely for first-time buyers to spot the difference,” says Chang.

Real estate consultancy firm Henry Wiltshire International (Malaysia) director Vicky How says many are not aware that the developer of a commercial property bears less liability than a developer of a residential property. Hence, one must take more care to deal with reputable developers when buying a commercial property.

The risks

“There are some commercial products that are rather misleading. Many purchasers buy them maybe because of attractive pricing or they think the property is the same as SoHo [Small-office Home-office], which is basically for residential purposes,” says How.

However, commercial properties with residential elements are regulated by different laws and guidelines from residential-use commercial properties such as some SoHos and serviced apartments.

In commercial properties with residential elements, the owners do not have the right to stay overnight in the property if the management does not allow them to. Such developments also do not fall under the jurisdiction of the HDA.

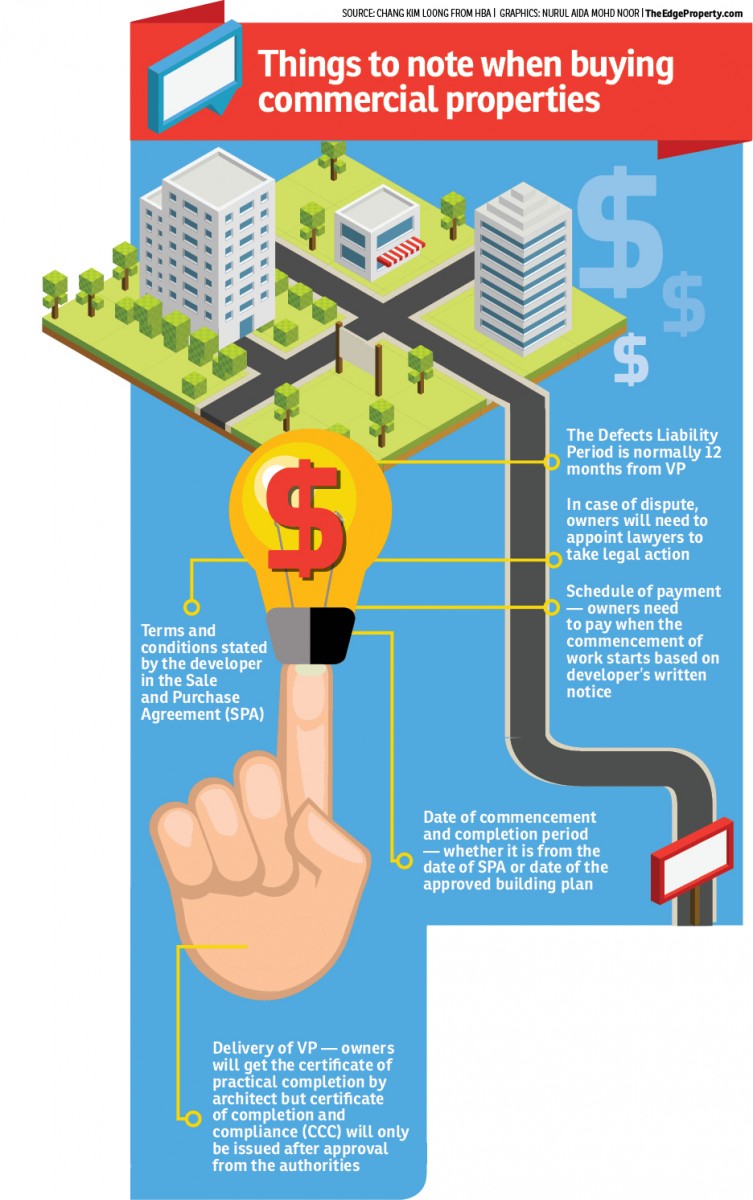

Chang notes that unlike for residential properties, the developers of commercial properties may not need to list down details such as the date of commencement and completion of the project, or the building plan and floor plan, in the Sale and Purchase Agreement (SPA) if the developer has not obtained the necessary approvals.

He adds that the developers of residential properties need to apply for the advertising permit and developer licence (APDL) before they can start placing advertisements to sell their products, while the developers of commercial properties do not.

“In case of dispute, strata homebuyers can bring up their cases to the Strata Management Tribunal. However, for commercial property purchasers, their legal recourse is through the courts and the arguments will be based on the SPA signed by both parties,” Chang says.

PW & Associates’ Tan points out that the rights of commercial buyers are strictly governed by the SPA with the developer. “If the developer breaches the SPA, the buyer will have to file a legal claim against the developer through the dispute resolution mechanism agreed in the SPA,” he explains.

Thus, Tan advises purchasers to engage their own lawyers to look into the SPA to safeguard their interests. “Unlike residential properties, which are governed by the HDA, commercial properties do not have a standard SPA. Therefore, buyers may be subject to unfavourable terms and be placed in vulnerable positions.”

The significance of the HDA

Chang from HBA explains that the HDA (amended in 2012) controls the development of “housing accommodation” and provides protection to homebuyers through Schedule H (for building or land intended for subdivision into parcels) and Schedule I (for build-then-sell stratified property), pursuant to the Housing Development (control and licensing) Regulations 1989 (amended in 2015).

Under the statutory SPA for residential properties, the developer is required to clearly state the details of the development to protect homebuyers. The details include the date of commencement and completion of the project, compensation for late delivery (LAD), the delivery of vacant possession (VP), defect liability period and schedule of payment of purchase price.

Over the years, amendments had been made to the Act to further protect buyers. One of the changes is that the housing minister has the right to prescribe any type of accommodation to become a housing accommodation (HDA (Amendment) 2007).

With this, the HDA could cover any residential property with a commercial title such as serviced apartments as well as any property intended partly for human habitation and partly for business premises such as SoHos, explains Tan.

However, How notes that SoVos and SoFos are not for residential use.

“Do not think you are buying a home when you buy one of these properties. If you are not signing the agreement under Schedule H, you are definitely not buying a residential property, which means you are not protected by the HDA,” How warns.

When purchasing a commercial property, Tan advises buyers to dive into the details of the terms and conditions before signing on the dotted line.

The points to note include the completion date of the property, defect liability period, the delivery of VP, whether LAD is payable by the developer and the buyer’s rights in the event of a breach by the developer.

“The rule of thumb should be this: When in doubt, speak to your lawyers, as they have the obligation to ensure that your legal concerns are addressed and your interests as a client are protected at all times,” he emphasises.

Besides scrutinising the SPA, How advises buyers of landed properties to check the land status on whether it is being subdivided, as well as the annual quit rent, as the charges vary for different property types. “For SoHo, SoVo and SoFo buyers, do ask for a copy of the agreement before making purchase decision,” she adds.

The costs

Some buyers may not be aware that commercial properties require higher maintenance fees, utility tariffs, insurance premiums, assessments and quit rents.

According to Tenaga Nasional Bhd’s website, the minimum monthly electricity charge for low voltage commercial premises is RM7.20, compared with RM3 for a private dwelling that does not carry out any form of commercial activities.

In Selangor, Syarikat Bekalan Air Selangor Sdn Bhd states on its website that the minimum water tariff for commercial usage is RM36 per month compared with RM6 for domestic usage. Meanwhile, the Shah Alam City Council imposes a 4% and 3.5% assessment rate on landed and stratified residential properties respectively, but the rate for serviced apartments is 5%. For shopoffices and offices, the assessment rate will be 7%. Local authorities have their own rates for property assessment in the areas under their jurisdiction.

In addition, according to the Royal Malaysian Customs’ guidelines on land and property development, commercial properties are subjected to the Goods and Services Tax.

Besides this, there is no exemption on the Real Property Gains Tax if a commercial property is sold within five years, whereas a residential property is entitled to a “once-in-a-lifetime” exemption.

In terms of transactions, Tan says if the title has been issued, the transaction is similar to a residential transaction. However, if the title has yet to be issued, a developer’s consent is required.

He highlights that for commercial properties, it is the duty of the seller to obtain the developer’s consent as a condition precedent to the sale or assignment. At times, a developer may impose stringent terms and conditions on the parties.

In comparison, in a residential property transaction, it is the developer’s duty to provide confirmation of the relevant records in the register upon request and an administrative fee (not exceeding RM50) would be imposed on the buyer pursuant to Section 22D of the HDA.

Still worth the investment

Despite the risks and costs, How believes commercial properties are worth the investment depending on the location and property type. Some could be very attractive.

“For typical shop units, the rental yield can range from 5% to 8%, while retail units in shopping malls can go up to 12%, depending very much on the retail/mall management,” she says.

As for warehouses or small factories with commercial titles, the yields are usually more predictable, ranging between 4% and 6%, as their tenancies are usually longer than for normal shops or retails units.

For properties like SoHos, SoVos and SoFos, the returns are usually within 3% to 5%, depending on location, demand, facilities and management of the property.

For first-time buyers who want to invest in a commercial property, How suggests looking into factories or warehouses with commercial title or stand-alone commercial shop lots with individual titles.

“The reason is that the purchaser owns the unit and does not have to rely on the retail management or the quality of the brands, which determines the quality of the crowd. Moreover, these landed properties are bought with the land value, so it appreciates as long as you hold them,” she says.

This story first appeared in TheEdgeProperty.com pullout on July 14, 2017. Download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.