Selangor sets precedent, waives penalties for unwitting purchase of bumi lots, but prevention still lacking

- Civil proceedings should be commenced to recover the millions in waived penalties, as the developer had unfairly benefitted from the sale of these properties and had obtained “unlawful enrichment”.

After four years of uncertainty, 207 non-bumiputera homeowners in USJ One Park, Subang Jaya, Selangor, can finally breathe a sigh of relief as the Selangor government has agreed to waive a staggering RM15.32 million in penalty fees early this year.

Besides being saddled with the penalty fees, these homeowners, who had unwittingly bought bumiputera-designated lots, were unable to obtain their strata titles.

However, following a persistent appeal via the Selangor Housing and Property Board (LPHS) to the state government, the hefty penalty was subsequently scrapped. The precedent could pave the way for other owners who are caught in a similar situation in Selangor.

“It was not right that owners were being held liable for something that was not their fault,” USJ One Park Joint Management Body chairman Gwee Chee Seng was quoted saying in The Star Metro.

“With the penalty lifted, we can now move forward with the long-delayed strata title process,” he added.

The daily also reported that the Selangor State Executive Council had granted permission for ownership transfers to the buyers and the transfer process must now be completed at a “reasonable fee”.

Additionally, the directors of the company responsible for the property development have been “blacklisted” from future projects in Selangor.

For the record, this is not an isolated case; there are plenty of house buyers in the same dilemma caused by developers overselling the bumiputra quota.

Bumiputera Housing Policy meant to help less well-off

This Bumiputera Housing Policy was introduced as part of the New Economic Policy in the 1970s to reduce the income disparity between the bumiputeras and non-bumiputeras. In a nutshell, the policy requires property developers to reserve a certain percentage of their units for sale exclusively to bumiputeras at discounted rates.

As land matters are under the purview of the respective state governments, the Bumiputera Housing Policy varies from state to state, ranging 30%–50% for bumiputera quotas and 7%–10% for bumiputera discounts.

The bumiputera quota has been credited by many quarters, including the National Housebuyers Association (HBA), for enabling less well-off bumiputeras to acquire properties, especially in the urban and suburban areas, and to avoid polarisation of neighbourhoods.

(On a separate note, perhaps the government should reconsider the relevance of such a blanket policy, which has been unchanged for more than 50 years. As it is, affluent bumiputeras are also eligible for the discounts even when buying multiple high-end million-ringgit properties. Shouldn’t the policy be updated to the current social demography?)

LPHS’s responsibility to detect breach

LPHS and the Selangor Land and Mines Office (PTGS) are supposed to monitor the sale under the bumiputera quotas (median 40% imposition in Selangor) with a bumi discount of 7% of the sale and purchase agreement price vis-a-vis residential per se irrespective landed or stratified.

The quotas may be released through a stringent “bumiputra release mechanism” that housing developers must abide by before the units may be sold to non-bumis. In Selangor, this is outlined in the Selangor Bumiputera Quota Maintenance Mechanism 2.0 circular issued by LPHS. We have written about the Perak Housing & Property Board which adopted a proactive measure for a timely release mechanism of bumiputera lots and we hope the Selangor Government will emulate such good practices.

Read also

Overhang properties precipitate developers’ ‘hangover’

However, there are several cases where housing developers “conveniently” oversell these bumi lots to non-bumis without going through the processes formulated for the periodical release of unsold bumi units. Somehow, the gatekeepers, that is, LPHS, have been caught unaware and a large percentage of bumi quota units have been sold undetected. The housing developers even had the audacity to confirm in writing to the affected buyers and their financiers/banks that the units were “not bumiputera” units.

Read also

Bumiputera lots: Why should innocent house buyers pay for state agencies’ negligence?

What is deemed ‘reasonable fee’?

In the case of the USJ One Park, both the land proprietor and property developer are under “creditors’ voluntary liquidation” and “wound up” respectively, and the transfers are now in the hands of two sets of private liquidators.

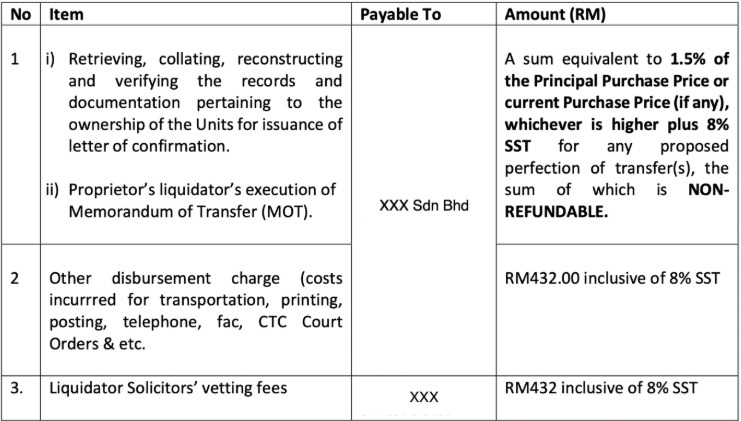

The liquidators have now given notice to all the affected owners of their desire to conduct a purported “ownership verification exercise and transfer of titles” and their fees are as stated below:

The question is whether the alleged “fees for verification” is deemed reasonable in the eyes of LPHS. Perhaps, the aggrieved owners could take a walk to the Court of Law to seek a declaration to determine what fee is deemed “reasonable”.

Liquidators merely ‘bare trustees’, not profit themselves

It is an established principle of law that upon full payments by purchasers, a developer becomes a “bare trustee” of the property. In other words, once a developer has received the full purchase price for a property, the developer is no longer the real owner of the property. The developer is merely holding the same property in trust for the benefit of the purchaser. The developer, as a bare trustee, has no beneficial interest in the property. It follows that a developer cannot deal with or treat the property as belonging to itself.

Once a liquidator is appointed, he steps into the developer’s shoes. It follows that the liquidator assumes the same role as a bare trustee and is not entitled to any other benefits more than the developer.

Similarly, a liquidator is not authorised to deal with the property other than to transfer the property to the rightful purchasers. Pending transfer of titles to purchasers, the liquidator is acting as an “interim caretaker” to the sold property. As a bare trustee, the liquidator is not allowed to profit himself using the trust property.

Read also

Victims of runaway developers face double woes from exploitative liquidators

Liquidators making fortune from homebuyers’ misfortune

‘Blacklisting’ does not curtail malpractice

On top of that, merely blacklisting the unprincipled directors from future developments does not serve as a deterrent. Those problematic developers will use proxies to set up separate companies to circumvent the “blacklisting”.

Read also

Blacklisting not a cure for late, sick and abandoned housing projects

Further action must be taken. The state government has the liberty to prosecute the directors, lodge police reports and impose fines. It should also advocate for “lifting the corporate veil” to hold each and every director personally liable as “officers of the corporation”. Civil proceedings too should be commenced to recover the millions in waived penalties, as the developer had unfairly benefitted from the sale of these properties and had obtained “unlawful enrichment”. If the government does not take action, it will open the floodgates for others to deliberately avoid completing title transfers and then liquidate the company while pocketing the money.

Finally, it is the duty of the Housing and Local Government Ministry to ensure all property titles are timely issued and transferred to buyers prior to taking of vacant possession.

Read also

Time to make ‘strata titles with vacant possessions’ a reality

This article is written by Datuk Chang Kim Loong, honorary secretary-general of the National House Buyers Association (HBA).

HBA is a voluntary non-government and not-for-profit organisation manned wholly by volunteers.

HBA can be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

The views expressed are the writers’ and do not necessarily reflect EdgeProp’s.

Want to have a more personalised and easier house hunting experience? Get the EdgeProp Malaysia App now.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.