IOI Properties chairman raises stake as shares hit all-time low

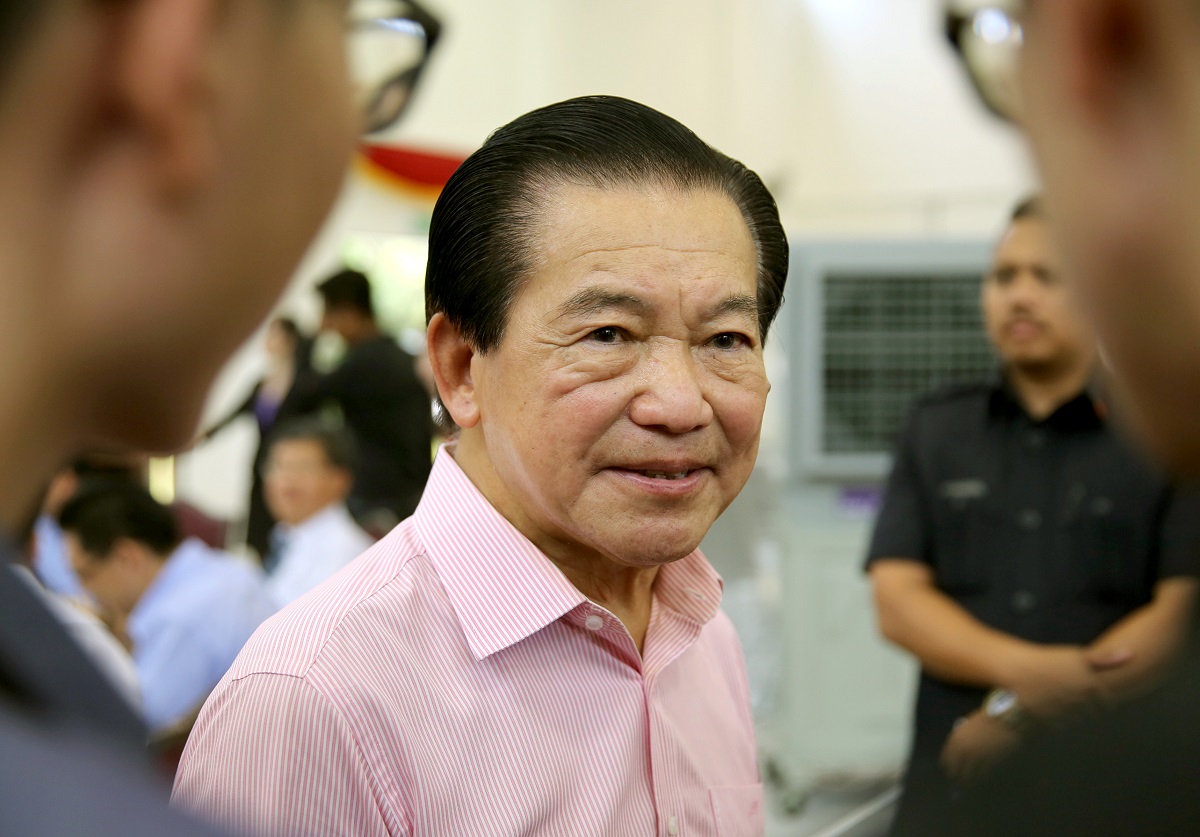

KUALA LUMPUR (March 28): Tan Sri Lee Shin Cheng (pictured), the founder of IOI Group Bhd, has been mopping up shares in the group’s property arm on the open market, even as the stock hit an all-time low on Monday.

Lee, who is executive chairman of both IOI Group and IOI Properties Bhd, acquired 1.02 million shares in the company that day, the latest in a series of purchases on the open market since end-February.

According to filings with Bursa Malaysia, he has bought a total of 26.44 million shares or a 0.48% stake in the company since the company’s share price began falling at end-February.

This increased Lee’s direct stake in IOI Properties to 2.77%, although he controls the company with an additional indirect interest of 60.79% via his private vehicle Vertical Capacity Sdn Bhd, a wholly-owned unit of Progressive Holdings Sdn Bhd, and the holdings of his children.

This, however, is not the first time Lee has bought into the company on a falling share price. In December 2017, he acquired 82 million shares over the course of a week after the counter fell from RM1.96 to RM1.79 between Dec 14 and Dec 19.

Shares in IOI Properties recovered yesterday from an all-time low of RM1.61 on Monday, rising one sen or 0.62% to close at RM1.62. The group has a market capitalisation of RM8.92 billion.

The company was listed in January 2014 at an offer price of RM2.51 per share.

The counter has fallen rapidly since February this year, when it reported a 60% plunge in net profit for its second quarter ended Dec 31, 2017 due to lower contribution from its overseas project

and an impairment loss.

The share price took another beating after the company announced on March 13 that it had terminated its proposed joint venture (JV) with HongKong Land International Holdings Ltd to develop the Central Boulevard in Singapore, which is worth at least US$2.84 billion (RM8.43 billion).

Affin Hwang Capital Research said in a report last Friday that it appeared both parties were unable to agree on the construction planning within the nine-month time frame since the JV was first proposed on March 12, 2017.

The group has said that it does not expect the development or its earnings to be materially impacted, and Affin Hwang has made no immediate changes to its earnings forecast.

But while the research house believes IOI Properties will see a higher asset value from the project upon completion, it cautioned that the company will have to finance the S$700 million to S$800 million (RM2.08 billion to RM2.38 billion) project alone.

“Hence, we expect the group’s net gearing to increase to 0.57 times from 0.55 times given the need to finance the construction costs,” Affin Hwang said.

Despite maintaining its “hold” recommendation on the stock, the research house lowered its 12-month target price to RM1.78 from RM2.26, widening its revalued net asset valuation to 50% from 40% previously.

This article first appeared in The Edge Financial Daily, on March 28, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.