ECRL suspension could delay retender phase

Construction sector

Maintain underweight: According to The Edge Markets, East Coast Rail Link (ECRL) project owner Malaysia Rail Link Sdn Bhd (MRL) has ordered its main contractor, China Communications Construction Co Ltd (CCCC), to immediately suspend all ongoing works relating to the engineering, procurement, construction and commissioning scope of the ECRL.

The suspension was invoked on the grounds of “national interest”, according to MRL. It will be in effect indefinitely, or until MRL provides further instructions to CCCC.

We are not surprised by the call for suspension as the new Pakatan Harapan government has said that it intends to renegotiate the ECRL’s costs and terms. Finance Minister Lim Guan Eng said in a statement on Tuesday the cost of the ECRL project at RM80.9 billion “must be reduced significantly to make it viable financially”.

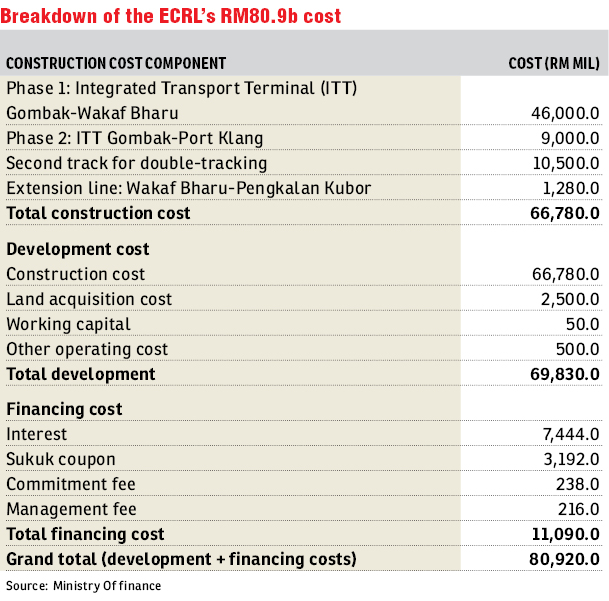

The aforementioned figure is made up of construction cost (RM66.8 billion), land acquisition cost (RM2.5 billion), working capital (RM50 million), other operational costs (RM500 million) and total financing costs (RM11.1 billion).

Additionally, Guan Eng said MRL had coughed up RM19.7 billion, or nearly 30% of the ECRL’s construction value. RM10 billion was paid out to CCCC as advance payment and another RM9.7 billion as progress payment.

In the worst-case scenario, MRL can recover the RM10 billion advance payment as it is backed by an advance payment bond of an equivalent amount. This advance payment bond may be redeemed by MRL to recover all of the advance payment.

Guan Eng also revealed that the Selangor state government opposes the ECRL’s second phase, running from the Integrated Transport Terminal in Gombak to Port Klang. The location runs within the vicinity of the Klang Gates Quartz Ridge, a quartz dyke that the state had applied to become a Unesco World Heritage Site. The ECRL’s phase 2 would disrupt this plan.

In our view, the suspension of works is likely to make way for a scaling-down phase and to limit additional loan drawdowns.

Recent media reports have indicated that the government intends to cut the ECRL’s construction cost to between RM30 billion and RM40 billion.

Using a 30% to 45% local subcontractors’ portion, this would translate into RM9 billion to RM18 billion.

We maintain our “underweight” stance on the sector. The progress of the ECRL has gone from bad to worse, with this latest decision to suspend works. Risks arising from a temporary stop-work order on the ECRL include further delays in the retender phase of the project involving local players, in our view. — CGSCIMB Research, July 4

This article first appeared in The Edge Financial Daily, on July 6, 2018.

For more stories, download EdgeProp.my pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.