M’sian REITs could become market darlings in 2019

KUALA LUMPUR (Jan 3): Stocks on Bursa Malaysia have endured a roller-coaster ride last year, with some creating big losses to investors on one day. Despite often seen as defensive investments, the Malaysian real estate investment trusts (M-REITs) also did not escape unscathed.

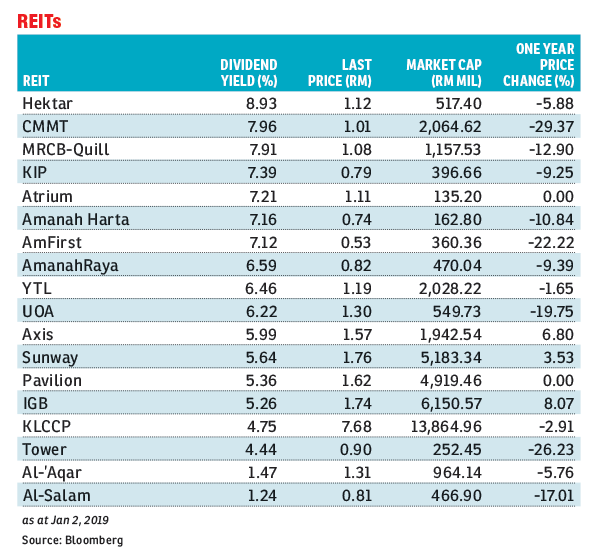

A check on Bloomberg revealed that the dividend yield of the 18 Bursa Malaysia-listed REITs averaged 5.95% currently, rendering the yield spread of M-REITs an unexciting 1.88% over the 10-year Malaysian Government Securities (MGS) yield of 4.07%. MGS is a typical benchmark to compare returns against the riskier REITs.

The performance of M-REITs was also uninspiring through most of 2018. Bursa’s REIT Index finished at 928.81 points on Dec 31, 2018, translating into a decline of 12.2% from 1,057.35 points on Dec 29, 2017, underperforming the benchmark FBM KLCI by nearly twice as much.

And analysts and industry experts are expecting things to stay unchanged this year unless REIT players seize the present opportunities to acquire more properties.

AmBank Research analyst Thong Pak Leng is of the view 2019 will be a modest year for the REIT sector with “nothing spectacular”.

“The [REIT sector] will be stable and yields will be generally flat. The yield spread (between M-REITs and MGS) is likely to stay at current levels,” he told The Edge Financial Daily.

In AmBank Research’s 2019 Market Strategy & Sector Outlook report dated Dec 13, Thong wrote that the outlook for retail properties, mainly shopping malls, remains resilient in the short to medium term.

“This is demonstrated by REITs under our coverage, namely Pavilion REIT and Sunway REIT, where both have high occupancy rates in their shopping malls. The high occupancy rates are also due to strong management and brand names of the REITs; and shopping complexes are becoming a one-stop centres for Malaysian lifestyle providing food and beverages and entertainment,” he said.

Thong’s top pick for the REIT sector is YTL REIT, saying it offers a proxy to the vibrant hospitality industry in Australia under the Marriott brand name, which has an attractive yield of more than 6% and more than half of its net property income backed by stable master leases.

He has a ‘buy’ call on the stock, with a fair value of RM1.35. YTL REIT units closed one sen higher at RM1.19 on Jan 2, 2019, bringing a market capitalisation of RM2.03 billion.

“Given the expectations of no interest rate hikes in 2019, we believe the prospects for M-REITs would be slightly better than in 2018. As the global volatility and uncertainty are likely to continue this year, M-REITs could in fact become the darlings of the market, provided they offer good and stable dividends,” Fundsupermart.com research analyst Jerry Lee Chee Yeong told The Edge Financial Daily.

According to Malaysian REIT Managers Association (MRMA) chairman, Datuk Jeffrey Ng Tiong Lip, the retail, office and hospitality sub-sectors are still facing intense competition arising from an oversupply, which has led to subdued or even negative distribution per unit (DPU) growth.

“The oversupply issue in the property market leads to a dilution of market share and potentially higher vacancy rates, which will then affect earnings of REITs.

“Furthermore, the property sub-sectors are expected to remain challenging in the absence of major foreign direct investments (FDIs) into the country or major catalysts to boost business spending and consumer consumption,” Ng pointed out.

He noted that attracting FDIs would be crucial in helping reduce the property overhang as it leads to more demand for space, therefore increasing the absorption rate of properties.

But industry players should also play their parts in optimising their capacities to seize opportunities by planning for a “major buying spree for 2019” as markets weaken, in order to build up their portfolio and profits, said AREA Management Sdn Bhd executive chairman Datuk Stewart LaBrooy.

“The performance in REITs will remain subdued for 2019 because there have been very few acquisitions in 2018, impacting their growth next year, but there will be many opportunities,” LaBrooy said when contacted.

“Players within the office and retail space, especially those struggling to maintain desirable occupancy rates — must also address vacancy issues head on by considering a diversification or repositioning of their assets, including converting empty offices into co-working space.

“The government is also looking at the securitisation of their assets or selling off their non-core assets. This gives the REIT market a chance to grow fairly quickly through organic growth, and through new REIT listings, making Malaysia a much stronger regional player,” he added.

This may refer to the government’s proposed Airport REIT, which Fundsupermart.com’s Lee is expecting it to deliver yields on par with the sectoral average of 5% to 6% in view of airport operators’ fixed income source.

This year, REIT players are also likely to see more offers in the market for acquisitions as vendors need to dispose of their properties to restructure their balance sheet and improve cash flow position, said MRMA’s Ng.

He believes that in a stable interest rate environment, M-REITs that practise active capital management have the opportunities to benefit from the low interest rate environment, thus lowering the average cost of debt where the interest savings will contribute positively to DPU.

“The booming e-commerce market will help as it generates demand for logistics centres and warehouses and while Internet-of-Things leads to demand for data centres, offering opportunities for REITs to undertake development activities for built-to-suit for their tenants,” said Ng.

Such efforts are under way for Sunway REIT, which planned to double its property value to RM15 billion by its financial year ending June 30, 2025 through a repositioning strategy by capitalising on broader emerging growth sub-sectors such as data centres, education campuses or facilities, and industrial and logistics assets.

Similarly, KIP REIT is mulling the diversification of its asset class while working on acquiring more third-party ready assets to grow its portfolio to RM2 billion in the next three years.

“For 2018, we have performed better in terms of yield compared with peers’ average. Our properties are unique in a way that our tenants serve the mass market and sells necessities, which allows our property income to be resilient against negative changes in the economic climate” said KIP REIT Management Sdn Bhd managing director Datuk Chew Lak Seong via email.

Inter-Pacific Research in a note on Monday advised investors investing in the sector to avoid real estate REITs that own assets in areas potentially facing a glut of retail space. “Our sole recommendation in this sector remains KIP REIT, a REIT that owns retail centres away from the too-hot Klang Valley office market which is potentially facing a significant glut of retail space,” it added.

This article first appeared in The Edge Financial Daily, on Jan 3, 2019.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.