MRCB's LRT3 progress billings expected to pick up in 2H

Malaysian Resources Corp Bhd (Aug 27, 72 sen)

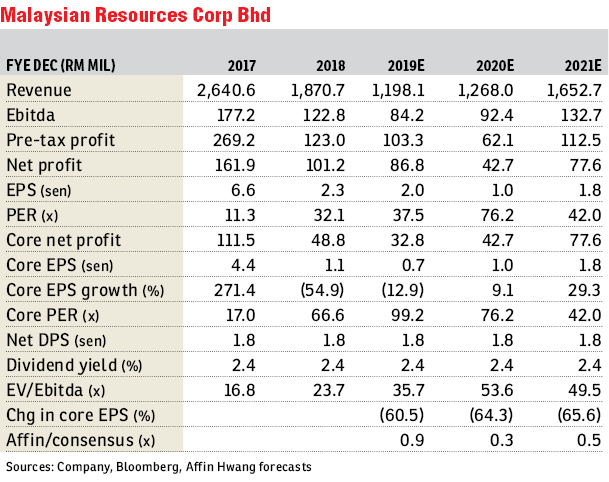

Maintain hold with a lower target price (TP) of 74 sen: Malaysian Resources Corp Bhd’s (MRCB) net profit of RM15 million (-72% year-on-year [y-o-y]) for the cumulative six months of financial year 2019 (6MFY19) is only 11% to 16% of the market consensus and our previous FY19 forecast of RM94 million to RM137 million. We were surprised by the low property earnings and joint-venture (JV) income. Revenue fell 43% y-o-y to RM475 million for 6MFY19 mainly due to slow progress billings for its property development division. The Klang Valley Light Rail Transit Line 3 (LRT3) project contributed a profit after tax of RM1 million for 6MFY19 compared with RM15 million for 6MFY18 to JV income due to work delays caused by the remodelling of the project to reduce costs. Both its construction and property divisions incurred operating losses due to slow progress billings and high operating costs.

MRCB achieved presales of RM244 million for 6MFY19 (compared with RM75 million for the first quarter [1Q] of FY19), which were mainly contributed by its Sentral Suites and TRIA condominium, 9 Seputeh projects. There are also property bookings worth RM130 million to RM140 million pending the signing of the sales and purchase agreements. MRCB has launched the Alstonia Hilltop project with a gross development value of RM247 million and an initial take-up rate of 8%. It has delayed further launches of new property projects as market sentiment remained weak. Unbilled sales of RM1.8 billion will likely shore up its property earnings as progress billings accelerate in the second half (2H) of FY19.

MRCB sold its 30% stake in the St Regis Hotel and Residences project to CMY Capital for RM117.3 million on May 23, 2019. The net disposal gain of about RM55 million boosted its earnings for 2QFY19. We cut our revalued net asset valuation per share estimate to RM1.23 from RM1.50 to reflect higher net debt, a lower property development discounted cash flow and lower construction arm valuation. Based on the same 40% discount to our TP, we cut our TP to 74 sen from 90 sen, but reiterate our “hold” call. Key upside/downside risks include stronger/weaker property sales and progress billings.

Progress billings for the LRT3 are expected to pick up in 2HFY19 with the reduced new contract value agreed with the government. MRCB’s share of works for the LRT3 is RM5.7 billion, contributing to 25% of its order book of RM22.6 billion. — Affin Hwang Capital, Aug 26

This article first appeared in The Edge Financial Daily, on Aug 28, 2019.

Click here for more property stories.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.