Napic’s and Rehda’s differing data—Which one reflects true market sentiment?

- We need improved data representativeness, accessibility, and interpretability to make informed decisions on the property market.

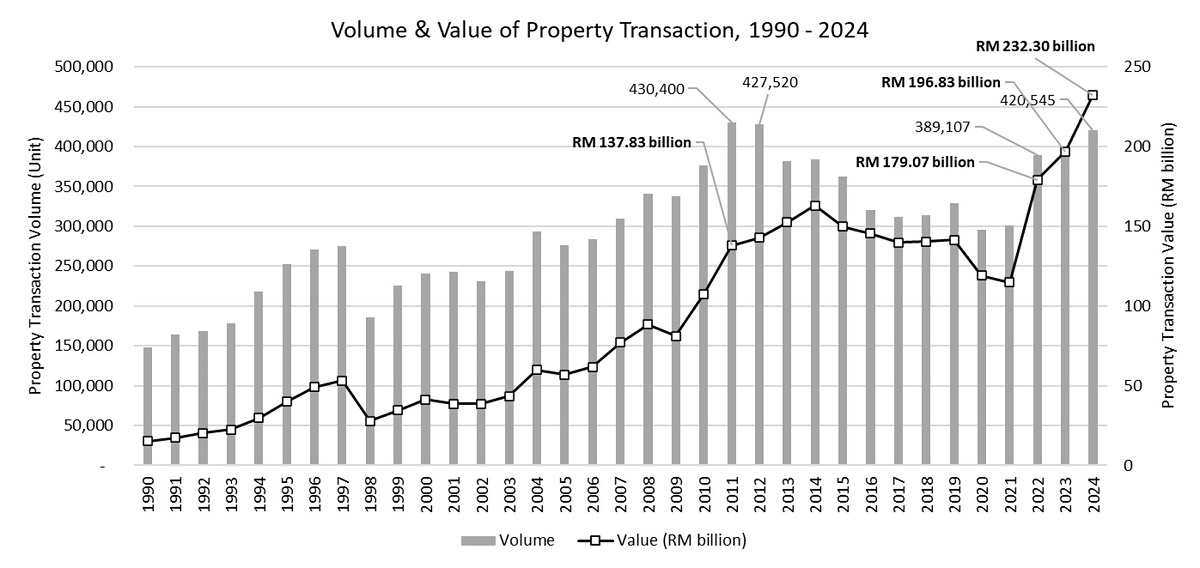

The Malaysian property market is said to have performed exceptionally well in 2024, with the total value of property transactions hitting a record high at RM232.3 billion, and the total volume of property transactions reaching 420,545, regaining the momentum of 2011. Compared to 2023, the transaction value increased by 18% from RM196.8 billion, and the transaction volume increased by 5.4% from 399,008 (Figure 1).

Figure 1: Volume and value of property transactions, 1990 – 2024

According to the National Property Information Centre (Napic), this remarkable growth was driven by robust market activity across all sub-sectors, underpinned by Malaysia’s 5.1% economic growth in 2024, favourable labour market and income conditions, availability of financing, as well as the continued incentives to promote homeownership and stimulate market activity, including the implementation of 23 new affordable housing projects under the People’s Housing Programme (PPR) and a RM10 billion Housing Credit Guarantee Scheme, easing of entry barriers for the Malaysia My Second Home (MM2H) programme, the implementation of key industrial projects in northern Malaysia, the launch of the New Industrial Blueprint 2030 and the Forest City Financial District in Johor.

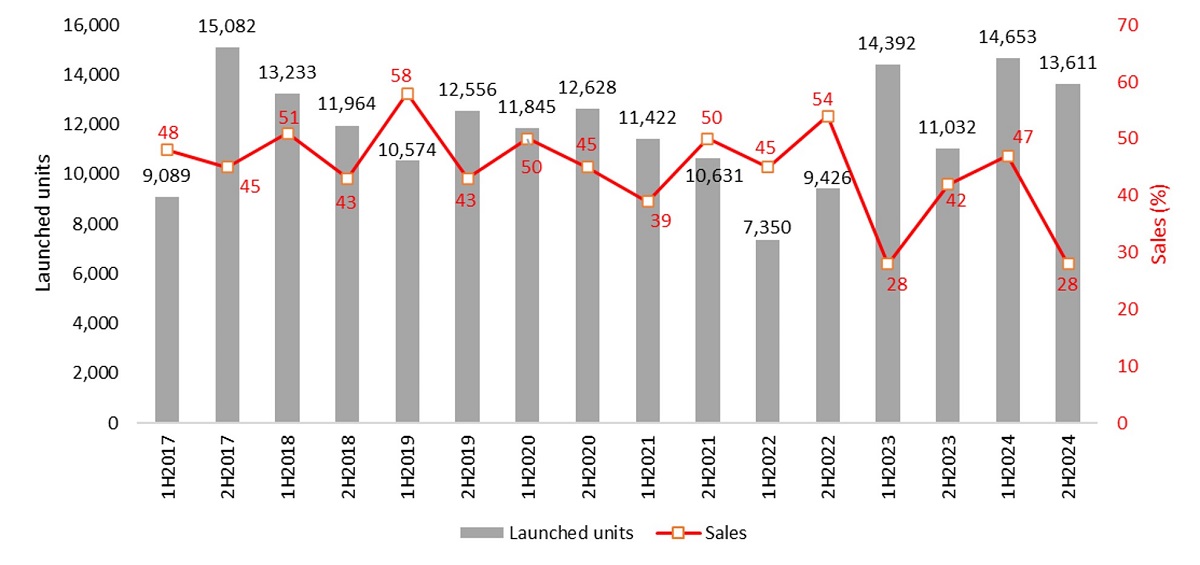

On the other hand, the Property Industry Sentiment Survey 2H2024 & Market Outlook 2025 conducted by the Real Estate Housing Developers’ Association Malaysia (Rehda) showed a 45% drop in property sales—from 47% in 1H20204 to 28% in 2H2024). The number of launched units also fell 7%—from 14,653 units in 1H2024 to 13,611 units in 2H2024 (Figure 2), as more than half of the developers (56% survey respondents) avoided property launches in 2H2024.

According to Rehda, the lower figures reported by the survey could be due to developers completing their launches in early 2024. Unfavourable market and business constraints such as financing and operations are among the main reasons developers have not been able to launch projects as planned in 2H2024.

This raises the question: Which source of information better depicts the market sentiment in Malaysia?

Figure 2: Residential new launches and sales performance on a six-month basis, 1H2017–2H2024

Different sources cover different perspectives

The fact is, both sources do not fully reflect the “true” sentiment of the market because they describe the market from different perspectives. Napic’s data covers market activity (volume and value of transactions), market inventory (existing, planned, under construction), and market status (new launches, sales performance, overhang, occupancy rates) across all sub-sectors (residential, commercial, industrial, etc) obtained from government agencies and real estate stakeholders in both the primary and secondary markets.

Meanwhile, Rehda’s survey only covers the status of the residential primary market, represented by the number of newly launched homes, sales performance, unsold units, etc. These data are obtained through Rehda’s survey of members every six months (or twice a year) and can be regarded as private developers’ perception on the current market performance. As such, any rise and fall in new launches or sales reported by developers are more reflective of the business cycle throughout the year that tend to be influenced by seasonal factors, economic cycles, and industry-specific patterns.

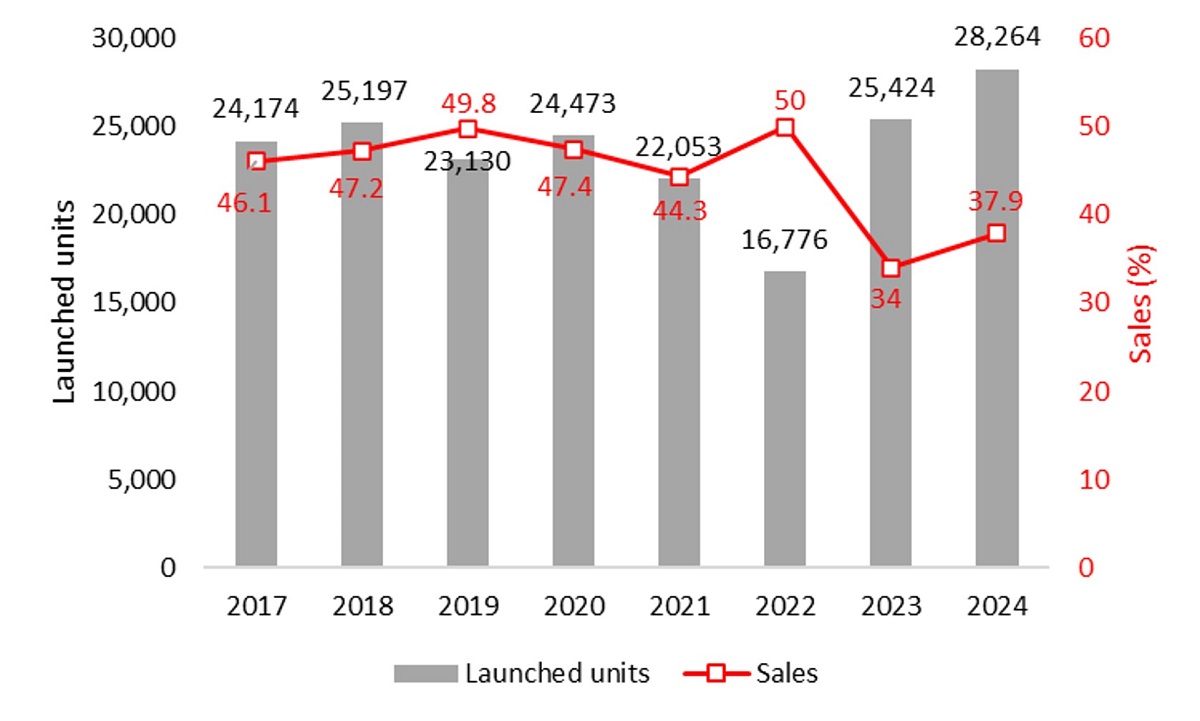

For example, new launches may see a decline in 2H2024 compared to 1H2024, but when compared to 2H2023 on a year-over-year (y-o-y) basis, they are up 23% (Figure 2). Similarly, new launches are up 11%, from 25,424 in 2023 to 28,264 in 2024 (Figure 3). In terms of sales, a relatively lower performance is observed in 2H2024, recorded at 28%, compared to 47% in 1H2024 (Figure 2). But, on an annual basis, sales performance saw an increase from 34% in 2023 to 37.9% in 2024 (Figure 3).

Figure 3: Residential new launches and sales performance on an annual basis, 2017–2024

Though 2024 sales (37.9%) has recorded the lowest performance since 2017 (except for 2023 where sales recorded at 34%), new launches have scored its highest level in the past seven years (Figure 3). The residential primary market is trending upwards from an annual perspective (Figure 3), in stark contrast to the “fluctuation” seen on a six-month cycle (Figure 2). This suggests that choosing the right time frame for data analysis is critical, as a market can have a poor quarter but still post modest annual performance.

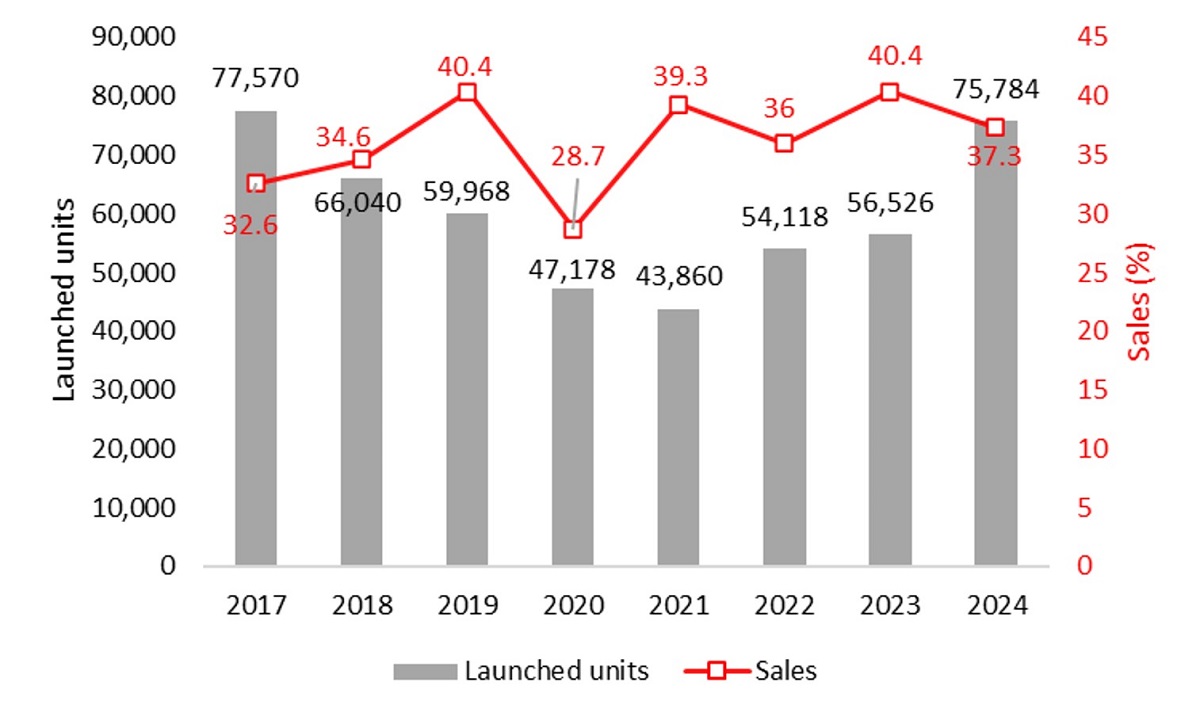

In addition to the time frame, the representativeness of the data is also crucial to ensure that it reflects the market behaviour. To note, both Napic’s and Rehda’s data on new launches and sales performance are not identical because of their different coverages. By comparing both Napic’s and Rehda’s findings on an apple-to-apple basis—using the new launches and sales performance, instead of the volume and value of property transactions—one can see a rising and recovering trend presented by the residential primary market. Napic’s data on new launches recorded a significant increase of 34.1% from 56,526 units in 2023 to 75,784 units in 2024, which is close to the highest number of new launches (77,570 units) ever achieved, in 2017 (Figure 4).

Figure 4: Residential new launches and sales performance based on Napic’s data, 2017–2024

Scopes of Napic and Rehda data

Since Napic is tasked with providing accurate property market information in the country, its data tends to be more comprehensive by covering all developers from all states in Malaysia. Meanwhile, Rehda’s survey only covers Rehda members that respond to the survey. For instance, only 177 survey respondents were involved in Rehda’s Property Industry Survey 2H2024 & Market Outlook 2025, compared to its membership of over 1,600 corporate members across Peninsular Malaysia. In this sense, Napic’s data is said to be “relatively” better in depicting the “true” activity of the residential primary market in the country.

Having said that, one should not overlook the significance of Rehda’s survey in reflecting the market sentiment. This is because Rehda members represent a significant portion of the property development in Malaysia by contributing to more than 80% of the total real estate built. More importantly, developers are more sensitive to market dynamics as they are directly involved in the rapidly changing nature of the business, which is heavily influenced by market trends, consumer needs, and the competitive landscape. As such, their views on market prospects can be a good indication of the market sentiment, especially in showing changes of the confidence levels among "big players" over a six-month period.

While Napic’s data provides fairly comprehensive coverage of market activity, status, and inventory, which is useful to understand the market sentiment; one should realise that this data could be oversimplified and can only be seen as a snapshot of the specific point in time, but is unable to fully capture the nuances of the market sentiment that are likely to be influenced by investor confidence, buyer psychology, and overall optimism or pessimism. This data should be studied alongside other market analyses such as interest rates, economic conditions, and government policies, in order to gain a more complete understanding of the “true” market sentiment.

Outdated data raising concerns

More importantly, Napic’s data on the residential primary market (including new launches and sales performance) may not be up to date as developers are not always required to inform Napic of changes to their projects, potentially leading to inaccuracies related to property demand and supply in the residential primary market. This can raise concerns among investors and stakeholders as they may not have access to detailed and specific information about the primary market conditions in a given area, and thus, negatively impact their ability to make informed investment decisions.

The issue of “outdated data” is even more pronounced in the sub-sale/secondary market as Napic’s data only shows official sub-sale transactions where stamp duties have been paid, rather than when the sale and purchase agreement (SPA) is signed. A transaction is considered official when the name on the title is transferred and the stamp duty for the transaction is made to the Inland Revenue Board (LHDN). This can cause a delay of several months or even a year after the SPA is signed; ultimately resulting in a time-lag between the sale of the property and the subsequent official registration of this information.

“Outdated” information may convey inaccurate market sentiment to investors and stakeholders, which could then lead to strategic misalignment, missed opportunities, financial losses, and most importantly, an imbalance in the national housing supply and demand system. For example, a record-breaking volume and value of property transactions may be interpreted by many as the beginning of a new upcycle in the property market and even a better new sales prospect, thereby stimulating more intensive development in the near term.

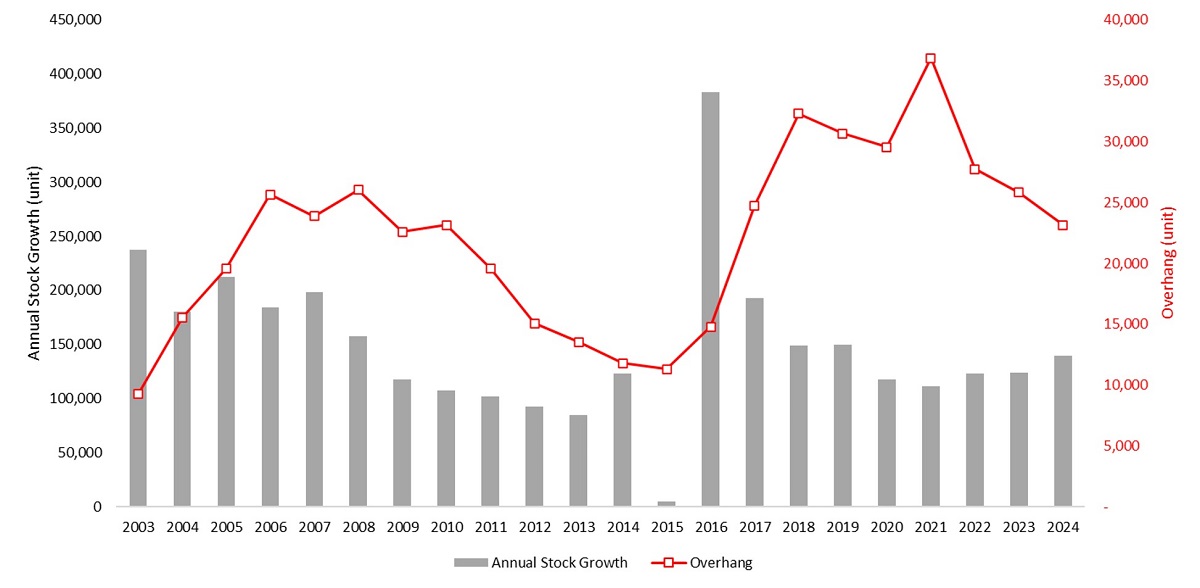

Figure 5: Annual residential stock growth and overhang, 2003–2024

This can lead to an oversupply in the market, regardless of local market absorption rates and buying interest, and ultimately resulting in a property overhang; as what happened in 2016. The sharp increase in overhang since 2017 is mainly due to the excessive supply of properties in the market following an “overheated” buying sentiment during the period 2010–2024, when the market was generally depicted as the explosive phase of the Malaysian property cycle (Figure 5).

Understanding the true market sentiment is not an easy task as it involves analysing various indicators such as economic conditions, interest rates, consumer confidence, and government policies which can be very complex and difficult to pinpoint. Sometimes, due to different data collection methods, data interpretation and time frames, the performance of these indicators varies, showing a contrasting trend that not only confuses many, but also makes it challenging to predict the exact direction of the market.

As such, data “end users” should not simply “judge a book by its cover”, i.e. they should not evaluate the source of data based solely on its appearance or initial presentation. Data end users should, instead, delve deeper to assess the data's quality, relevance, and suitability for their needs. This includes understanding the data's origin, collection methods, potential biases, and limitations.

Dr Foo Chee Hung is the principal researcher from MKH Bhd.

The views expressed are the writer’s and do not necessarily reflect EdgeProp’s.

Want to have a more personalised and easier house hunting experience? Get the EdgeProp Malaysia App now.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.