Analysts upbeat on M-REITs’ dividend yields amid easing rate outlook

- The key catalysts are anticipated in 2H2025, including asset recycling through disposals or new acquisitions, asset enhancement initiatives to drive income growth, and a hospitality sector recovery following the seasonal post-Ramadan rebound.

KUALA LUMPUR (June 10): Analysts said Malaysian real estate investment trusts (M-REITs) could continue to provide defensive yields, amid an easing interest rate outlook.

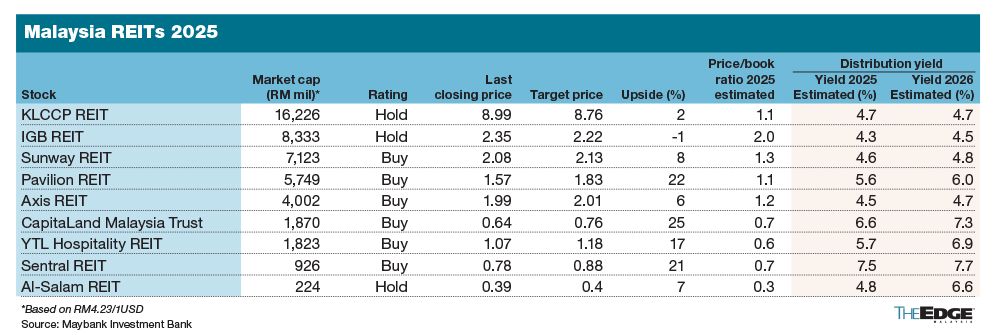

In a research note on Tuesday, Maybank Investment Bank (Maybank IB) said that M-REITs are projected to deliver attractive average dividend yields of 5.6% in 2025 and 6.1% in 2026, offering healthy yield spreads of 208 to 258 basis points over the current 10-year Malaysian Government Securities yield of approximately 3.5%.

Maybank IB see room for spread compression if potential overnight policy rate cut materialises in the second half of 2025 (2H2025), benefitting REITs with higher floating-rate debt exposure, which is averaging around 47% across the sector by lowering financing costs and supporting valuation upside.

The key catalysts are anticipated in 2H2025, including asset recycling through disposals or new acquisitions, asset enhancement initiatives to drive income growth, and a hospitality sector recovery following the seasonal post-Ramadan rebound.

Other strategic catalysts include asset diversification, such as expanding into industrial segments or reducing reliance on single asset classes like office properties, repositioning through asset recycling and mall reconfiguration, and pursuing new acquisitions and placements. These initiatives are designed to enhance valuations and support medium-term yield and distribution growth.

Maybank IB maintains a positive view on the M-REITs sector, supported by resilient fundamentals, attractive yields, and visible catalysts for income growth expected in the 2H2025.

Maybank IB has named Sunway REIT (KL:SUNREIT) as its top pick, with a target price of RM2.13. Other recommended “buy” calls include Pavilion REIT (KL:PAVREIT) at RM1.83, and Axis REIT (KL:AXREIT) at RM2.01. The research house also highlights high-yield options such as YTL Hospitality REIT (KL:YTLREIT) with a target price of RM1.18, Sentral REIT (KL:SENTRAL) at 88 sen, and CapitaLand Malaysia Trust (KL:CLMT) at 76 sen.

However, the research house has highlighted potential risks such as the proposed 8% service tax on rentals, which could raise costs for tenants and limit REITs’ ability to increase rents, as well as possible hikes in electricity tariffs, changes to fuel subsidies, and ongoing tariff disputes.

CGS International noted that REITs with lower-quality portfolios may need to provide rental support to retain tenants, potentially impacting earnings and distributions as tenant costs rise. In contrast, prime assets such as Mid Valley Megamall and Pavilion KL are expected to stay resilient, backed by strong tenant profiles and steady footfall.

At the time of writing on Tuesday, shares of Sunway REIT were up four sen or 1.9% to RM2.12, with a market capitalisation of RM7.26 billion. Shares of Pavilion REIT were down one sen or 0.6% to RM1.56, with a market capitalisation of RM5.71 billion.

Shares of Axis REIT were down one sen or 0.5% to RM1.98, with a market capitalisation of RM4 billion. Shares of YTL Hospitality REIT remained flat at RM1.07 with a market capitalisation of RM1.82 billion. Shares of Sentral REIT were up 0.5 sen or 0.7% to 78 sen, with a market capitalisation of RM932.5 million. Shares of CapitaLand Malaysia Trust remained flat at 64 sen, with a market capitalisation of RM1.87 billion.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.