Guan Eng moots creation of special financial zone in Seberang Perai

- Bagan member of Parliament Lim Guan Eng: Penang, which lacks natural resources, needs a fresh economic driver to maintain its momentum and advance further.

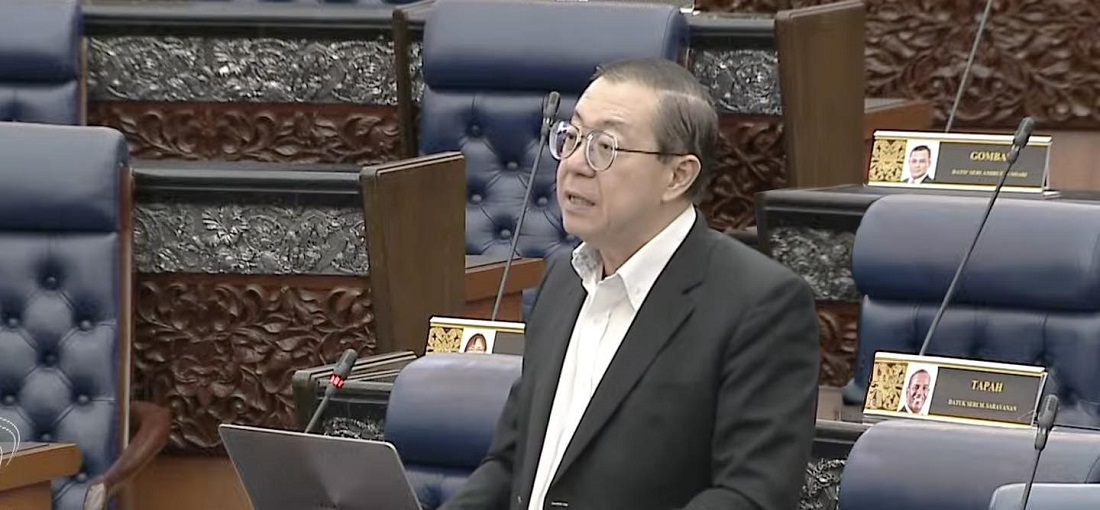

KUALA LUMPUR (Oct 16): Bagan member of Parliament Lim Guan Eng (pictured) has proposed the establishment of a special financial zone (SFZ) in Penang as a new economic catalyst to sustain growth in the state, amid escalating global trade tensions.

Debating Budget 2026 in the Dewan Rakyat on Thursday, the former finance minister said Penang is Malaysia’s only fully industrialised state, with 95% of its gross domestic product (GDP) derived from the manufacturing and services sectors.

He said this makes the state particularly vulnerable to renewed tariff threats from US President Donald Trump, including the possibility of a 100% duty on semiconductor chips.

“Penang, which lacks natural resources, needs a fresh economic driver to maintain its momentum and advance further,” Lim said.

He suggested that Ampang Jajar—located between the Permatang Pauh and Bagan parliamentary constituencies in Seberang Perai—be developed as a special financial zone.

“The 100-acre site, located near Penang Port and the upcoming light rail transit line, is strategically positioned to serve as a new growth hub for the state.

"It is time for Seberang Perai to be chosen as a focal point to ensure more balanced development for semi-urban communities,” he added.

Malaysia's only special financial zone is located in Johor's Forest City. First announced in 2023 and launched in September last year, it offers various incentives including special income tax rate for knowledge workers, zero tax for eligible single family offices, and 5% concessionary tax rate for certain financial technology companies.

Protect SMEs from global tariff fallout

Meanwhile, Lim also urged the government to strengthen support for small and medium enterprises (SMEs), warning that the sector is under mounting pressure from the ongoing global tariff war.

He cautioned that trade tensions could trigger an influx of cheap imported goods as producers seek alternative markets after being shut out of the United States, with some selling products below production cost.

“The closure of the US market could also lead to more public and private projects worldwide being bid at significantly lower prices, as foreign bidders can source materials cheaply from their home countries,” he said.

Describing SMEs as “eggs at the edge of a cliff”, Lim said many are struggling with higher costs from recent policy changes, including the expanded scope of the sales and service tax (SST), e-invoicing implementation, new dividend tax measures and the Employees Provident Fund (EPF) contribution requirement for foreign workers.

To support local businesses, he proposed that all foreign investors and contractors—whether involved in public or private projects—be required to source at least 50% of materials and supplies from local producers.

Lim also called on the government to strictly enforce anti-dumping measures and consider setting up a dedicated fund to assist SMEs affected by the tariff war.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.