Understanding home loans

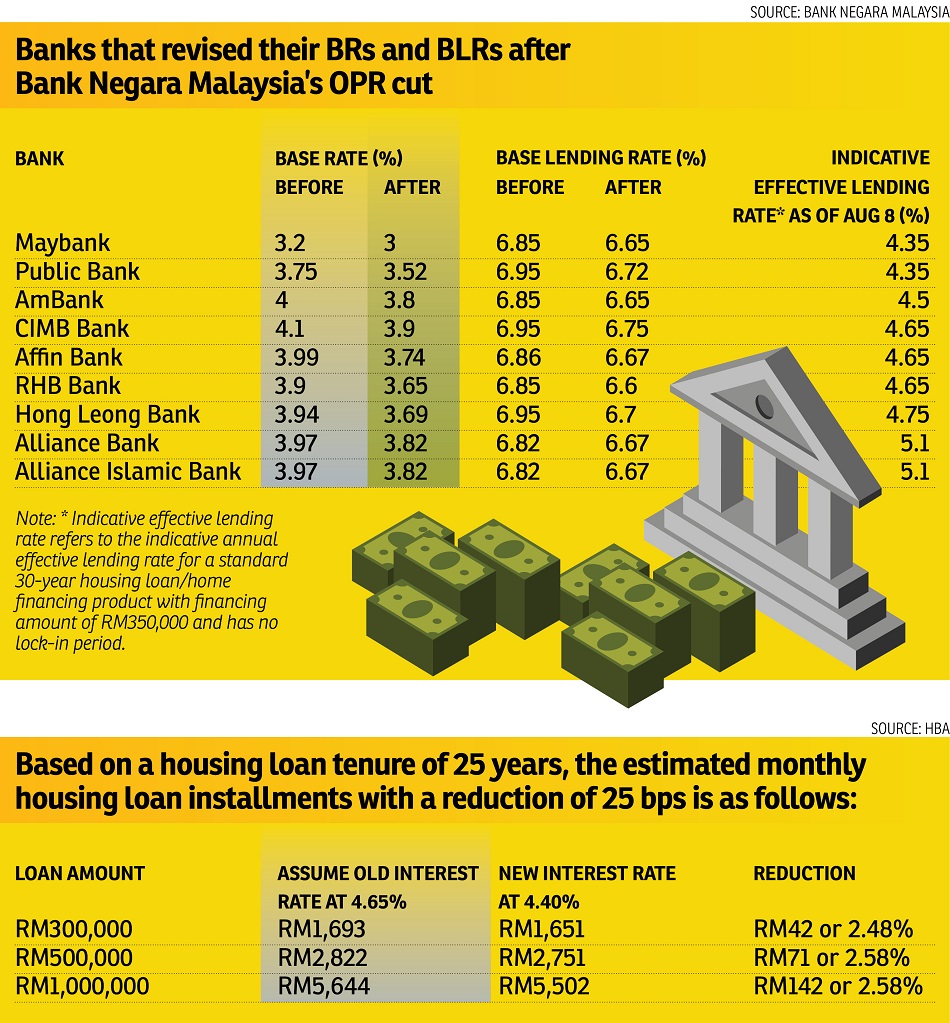

WITH Bank Negara Malaysia (BNM) having cut the overnight policy rate (OPR) by 25 basis points to 3% from July 13, 2016, some major banks have reduced their base rates (BR) and base lending rates (BLR).

Among these banks, Maybank was the first to react. The bank lowered its BR and BLR by 20 basis points to 3% and 6.65%, respectively, with effect from July 15.

Subsequently, Ambank, CIMB, Public Bank, Hong Leong Bank, RHB and Affin Bank reduced their BRs and BLRs as well.

The cost of loans will be lower as banks decrease their BRs, making current borrowers and property buyers the winners, Ideal Mortgage Specialist Sdn Bhd head of marketing Vincent Ching tells TheEdgeProperty.com.

Banks reduce their BRs in order to maintain their competitiveness, he says. “Normally, when one bank lowers its BR, other banks will follow.”

With the current relatively low interest rate environment and with more BR cuts expected in future, should a first-time homebuyer be motivated to consider buying property now? In such a competitive financing environment, how does one choose a loan with the so-called “best interest rate” or that best suits one’s repayment needs?

Ching says that based on the current soft property market, there may be some great deals.

“Besides the BR cuts, first-time buyers can also take advantage of the various schemes such as MyDeposit, My First Home Scheme, PR1MA, RUMAWIP and so on. But bear in mind, for first-time buyers, it is important to buy within their financial capabilities,” he says.

However, The National House Buyers’ Association (HBA) honorary secretary-general Chang Kim Loong says that a reduction of 25 basis points in the BR is not material, and prospective house buyers must carefully assess their ability to repay the monthly loan obligations and only go ahead with the purchase if they are certain that they have no problems in servicing the loan instalments.

“Although the reduction is very much welcomed, it cannot be the deciding factor on whether a prospective house buyer should pursue their dream home,” he says.

In choosing a home loan, Chang advises potential house buyers to check out as many banks and financial institutions as possible to gauge the best terms as different banks have different criteria and risk appetite.

“Prospective borrowers will need to compare the rates received from the various banks and the terms and conditions attached to the loan before shortlisting the bank with the best package for them,” he added.

Ching concurs that homebuyers have to scrutinise a few banks first before shortlisting two to three banks.

“Banks assess each applicant individually based on nett income, commitment, repayment, etc, before determining whether he/she is qualified to borrow the desired amount,” he says.

“Banks have many considerations for loan approvals but the rates offered by them are generally about ±0.1%-0.2%,” he adds.

According to Ideal Mortgage Specialist Sdn Bhd senior marketing manager Steven Cheong, banks usually set the interest rate on a mortgage based on two factors. First is the loan amount. Second is the borrower’s credit profile. “If the credit score is good, the buyer may get better interest rates, and vice versa,” he offers.

RHB Banking Group head of group retail banking U Chen Hock says that mortgage interest rates differentiation among the various banks in the country is currently negligible due to the prevailing competitive landscape of the industry.

Fixed and floating rates

There are basically two types of interest agreements on home loans: fixed and floating.

The fixed agreement refers to the fixed interest rate on the product that remains constant throughout the lifetime of the facility.

“This product offers peace of mind knowing that the pricing will remain the same throughout the loan tenure. Such a premium feature however, comes at a higher pricing compared with a floating rate product,” U says.

On the other hand, a floating interest rate home loan comprises a variable component, namely the BR. The interest rate is expressed as BR plus spread. The BR will be subjected to fluctuations in the event of movements in the benchmark cost of funds, he explains.

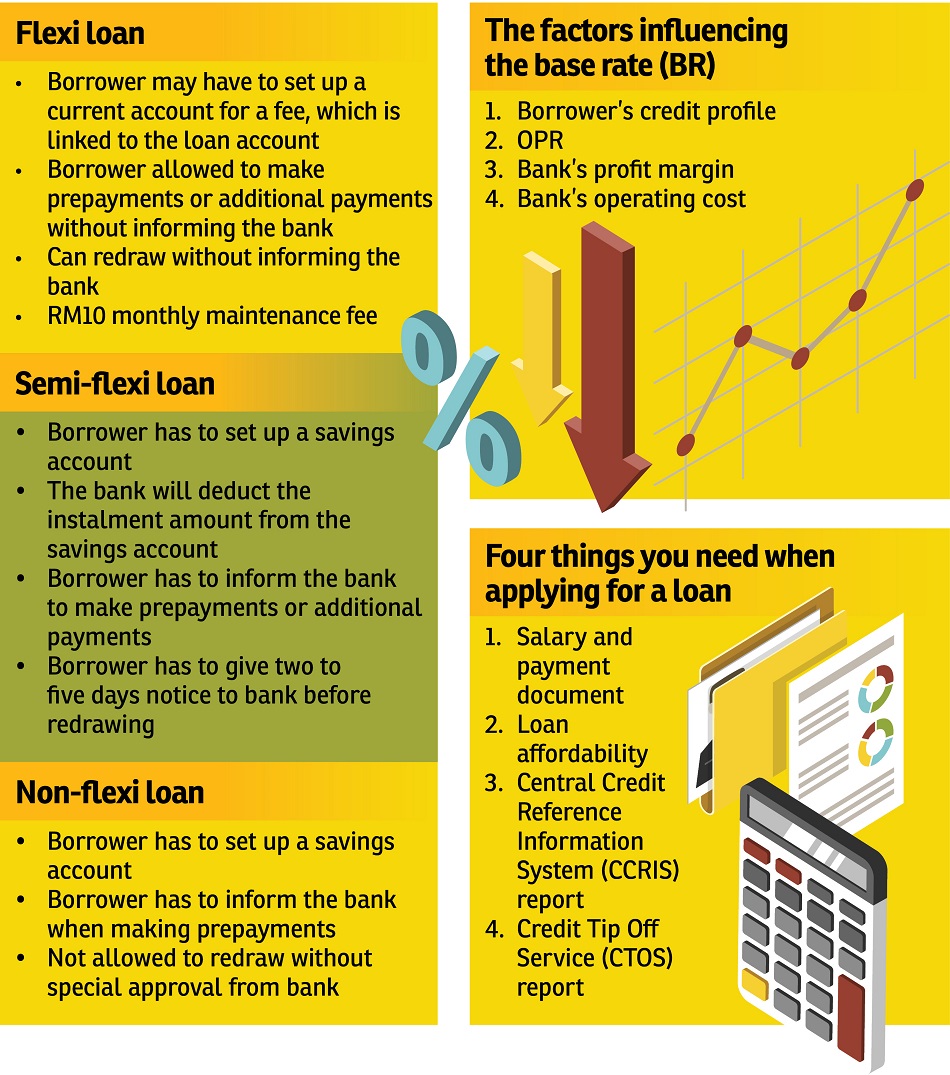

Besides the OPR movement, factors that will affect the BR also include the borrower’s credit profile, and the bank’s operating cost and profit margin.

U says that due to the current accommodative interest rate environment, most mortgage products are offered as floating rate schemes.

Conventional and Islamic loans

There are two concepts of mortgage in Malaysia — the conventional loan and the Islamic loan. To comply with Shariah principles, the Islamic loan must comply with Al Bai Bithaman Ajil (BBA), Musharakah Mutanaqisah, Musharakah and Ijarah contract, explains Ching.

Both the loans are divided into three categories — flexi, semi-flexi and non-flexi. Compared with conventional loans, Islamic loans have a few advantages.

“There is a 20% stamp duty discount for Islamic Loan Agreement documents, and the so called interest rate of Islamic loans are capped at a ceiling rate of up to 10.75%,” says Ching.

Also, when refinancing from a conventional mortgage to an Islamic one, there is a 100% stamp duty waiver on the existing refinancing loan balance, Ching adds.

Furthermore, in contrast to conventional loans, which usually have a three-year lock-in period, most Islamic home financing packages do not have a lock-in period.

During the lock-in period, borrowers are not allowed to refinance or fully settle their loans unless they pay a penalty of 2% to 3% on the loan outstanding.

Flexi, semi-flexi and non-flexi loans

Home loans are also categorised as flexi, semi-flexi or non-flexi loans. “Flexi” features give greater flexibility, namely the ability to make additional payments over the monthly instalment amount. The additional payments will be used to immediately offset the principal balance outstanding resulting in interest savings, explains U.

In addition, the prepaid amount can be used in future if the need arises by redrawing against the accumulated prepaid amount, he says.

“With the two features, mortgage products are now becoming transactional products that enable customers to prepay and redraw at any time, as opposed to a typical loan that limits transactions to only monthly instalments,” U adds.

Under a normal non-flexi mortgage, however, borrowers are not allowed to do any prepayment and redrawing, he adds.

As for semi-flexi loans, a borrower can do prepayments but they have to serve a two-day notice to the bank if they want to redraw from the prepaid amount.

Ching suggests that borrowers go for the semi-flexi loan instead of the flexi loan as the latter may incur extra costs.

“Some banks will charge the flexi loan borrower a set-up fee of RM200 and a monthly maintenance fee of RM10, so these are the extra costs,” he notes. And if a borrower doesn’t make additional payments, he or she will not benefit from the interest savings feature of the flexi loan but would have incurred more cost anyway, he adds.

Ching says buyers need to find out all the costs involved in buying a property to avoid buying something they can’t afford.

“The main reason buyers face difficulties getting a mortgage is because they are buying something they can’t afford,” he says.

Besides the cost of a property, buyers should know that there are other costs like down payment, stamp duty and valuation fees, Cheong adds.

How to choose?

How to choose?

When deciding on the type of mortgage, HBA’s Chang reckons that there should be no real difference to the borrower whether their housing loan is under the conventional financing or Islamic financing.

However, the borrower should ensure that early redemption or repayment of the facility is allowed under the Islamic financing facility as the previous generation of Islamic financing by certain banks did not have provision for early redemption which posed problems to borrowers wishing to settle their housing loan early or to dispose the property, he adds.

The choice of a fully-flexible loan or semi-flexible loan account depends on the needs of the borrower, he offers.

“If the borrower prefers to make regular pre-payments and withdrawals, then a fully-flexible loan account is more suitable. But if the borrower is not going to make regular pre-payments or withdrawals, then a normal semi-flexible loan account would suffice.”

Ultimately, borrowers should choose what suit their lifestyles and requirements.

Want to know your monthly instalment before and after the OPR cut? Check out the mortgage calculator on TheEdgeProperty.com.

Base rates and effective lending rates

In a mortgage, the effective lending rate refers to the rate that a consumer pays for a loan facility.

Meanwhile, the BR is determined by the financial institutions’ benchmark cost of funds and the Statutory Reserve Requirement (SRR). Other components of loan pricing such as the borrower’s credit risk and liquidity risk premium, and the bank’s operating costs and profit margin will be reflected in a spread above the BR. According to BNM’s website, the Base Rate (BR) replaced the Base Lending Rate (BLR) as the main reference rate for new retail floating rate loans effective Jan 2, 2015.

The effective rates come under the cost-plus structure which is translated into the “BR + spread”.

“Since the introduction of the new framework, all financial institutions now have their own independent published BR and spreads,” says RHB Banking Group head of group retail banking U Chen Hock.

A revision in the BR will impact the effective lending rate of a mortgage facility, thus it would entail a revision of the instalment amount, U adds.

The spread on the other hand is fixed upon entering a mortgage contract, unless there is a change in the risk profiling of a borrower particularly due to deterioration of the mortgage account, which includes non-servicing of the monthly instalments, he notes.

“Under such circumstances, the financial institutions are allowed to vary the spread to reflect the risk of the mortgage account,” U says. “Such provisions are reflected in the Letter of Offer and consumers are advised to peruse the terms.”

This story first appeared in TheEdgeProperty.com pullout on Aug 12, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.