UEM Sunrise feeling the pinch of weak consumer sentiment

UEM Sunrise Bhd (Jan 3, RM1.05)

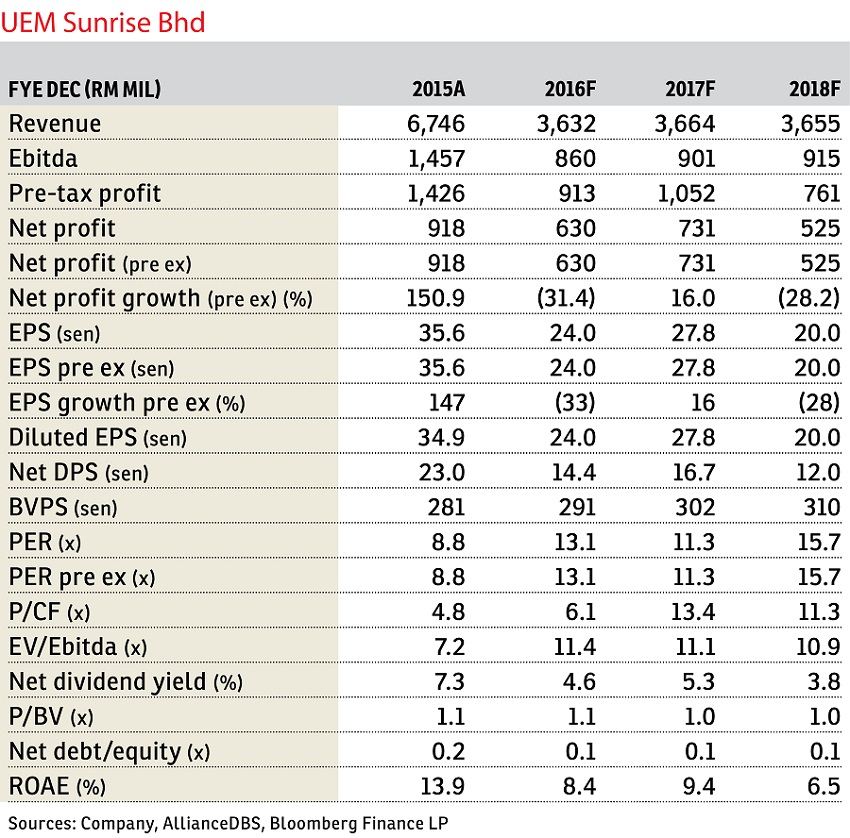

Maintain hold with a target price (TP) of RM1: UEM Sunrise Bhd enjoys the advantage of low land cost in Iskandar Malaysia, as the master developer of Iskandar Puteri.

However, after the strong price appreciation of land and properties in recent years, the market started to grapple with increasing property supply, especially high-end condos, which have been exacerbated by the aggressive entry of Chinese developers.

The weak sentiment towards Iskandar Malaysia’s properties had also severely affected UEM Sunrise’s property sales in Iskandar Puteri which plunged from RM1.9 billion in financial year 2013 (FY2013) to RM300 million in FY2015.

Near-term earnings visibility is supported by RM4.1 billion unrecognised revenue. This is equivalent to 2.7 times FY2017 property development revenue, and the group will not need to rely as much on land sales.

Management set a revised sales target of RM1 billion for FY2016 (RM2.4 billion in FY2015) in August 2016, and it had achieved RM707 million sales in the cumulative nine months of 2016 (9MFY2016) as only three projects worth RM558 million in gross developmental value were launched in 9MFY2016.

While 75% of UEM Sunrise’s land bank is located in Nusajaya, management has been trying to diversify beyond Nusajaya by launching more projects in the Klang Valley and overseas.

Also, UEM Sunrise has been incorporating more affordable homes into its launches in view of the weak property market sentiment which has led to more aggressive marketing being undertaken to boost sales.

We maintain our “hold” call for UEM Sunrise with a TP of RM1, based on a 70% discount to our revalued net asset valuation.

About 75% of UEM Sunrise’s 5260.91ha of remaining land bank is concentrated within Iskandar Malaysia, and the group may not be able to monetise the deep value of its land there anytime soon given the weak sentiment towards Iskandar Malaysia properties, especially high-end condominiums.

Key risks to our view include the potential oversupply of high-end condos in Iskandar Malaysia. Property prices there are also comparable with more matured areas (Kuala Lumpur and Penang), which may not be sustainable. — AllianceDBS Research, Jan 3

This article first appeared in The Edge Financial Daily, on Jan 4, 2017. Subscribe to The Edge Financial Daily here.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.