Should you opt out of the loan deferment?

Bank Negara Malaysia (BNM), on March 24, 2020, announced an automatic six-month moratorium on all bank loans starting from April 1, to assist borrowers who are facing temporary financial difficulties due to the COVID-19 outbreak.

The deferment package allows small and medium enterprises (SMEs) and individuals to delay their loan repayments up to six months from April 1. The deferment includes conventional loans and Islamic financing repayment obligations (including mortgage loan and hire purchase loan), except for credit card balances.

The question is, should individual borrowers such as for housing loans, take the deferment?

In view of the current Movement Control Order (MCO) which began on March 18 and has affected businesses and jobs, any moratorium on loan repayments would seem welcome to ease cash flow.

Malaysian Institute of Estate Agents (MIEA) president Lim Boon Ping said the automatic deferment came just in time to help alleviate property buyers’ repayment burden as many wage earners have been affected by the virus outbreak and the MCO, especially those in the tourism, hospitality and retail sectors.

For one, the money saved from the moratorium could be kept for more “rainy days” ahead, considering current and future uncertainties.

“How soon will the COVID-19 be over? How fast will the post-crisis economic recovery be? What about political stability?” Lim asks.

MIEA had earlier urged the government to extend the loan repayment moratorium to individuals who are facing financial difficulties during the partial shutdown of the country.

For those who are earning daily wages or who earn commission-based income, the deferment on monthly loan repayment will help them get through these tough times, as they could have more cash to pay for more urgent daily expenses, says Lim.

Business consultancy firm YYC Holdings Sdn Bhd CEO Datin Yap Shin Siang notes that SMEs will be the biggest beneficiaries as they are among the most affected by the MCO.

Before the automatic moratorium was announced by BNM, many banks had already decided to offer loan deferment packages but they required SMEs to submit at least six months of income statements to prove their repayment capability while the application process was time-consuming and approval was on a case-by-case basis.

“The COVID-19 outbreak started early this year, resulting in many SMEs being affected by poor market sentiments and a slow market. A lot of them might not have sufficient cash flow to sustain for another two months as their customers are facing financial problems and may not pay them on time.

“The automatic moratorium on loan repayment will give them a breather to strategise and wait for the economy to rebound, after the MCO period, when most companies are forced to halt their operations,” says Yap.

For individuals, especially housing loan borrowers, she urges them to accept the deferment packages as this could help them build up contingency funds in case the MCO is extended or if there is a prolonged period of sluggish growth.

“We all have to be in survival mode and prepare for the worst,” she stresses.

Even for landlords who do not need to worry about monthly instalments previously, they may also be affected now, as tenants who are facing financial hardship will ask for rental reductions or deferments.

Not free money

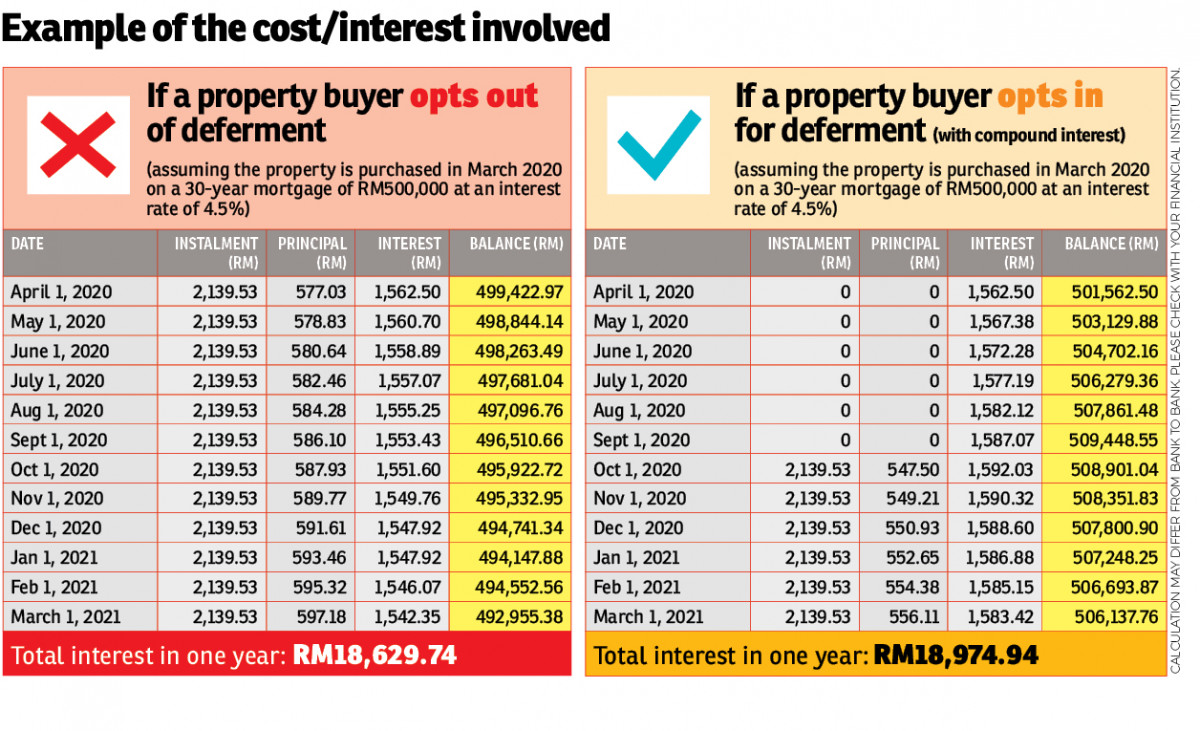

Borrowers however, must keep in mind that the loan interest will continue to accrue during the period of the moratorium.

Loan repayments will resume after the deferment period. Interests would continue to be charged on the outstanding balance comprising both principal and the interest portion (compounded) during the deferment period.

“But in tough times like this, liquidity comes first. Individuals could cancel the deferment package even before six months once market conditions get better,” says Yap.

While lauding the government’s move with the aim of reducing the financial burden on the rakyat, MIEA’s Lim wants to remind borrowers that the deferment package does not mean you now have “free” money to spend.

“Individuals will need to evaluate their own financial condition, count the cost of the deferment and make a decision.

“One of the good things about this loan deferment is that individuals have the option whether to take it or not. If they choose to do so, they must understand that there will be a cost, especially if interest is compounded. For big spenders, I would suggest they take the deferment, as it could help them conserve cash when things get worse,” Lim counsels.

Nevertheless, most major banks operating in the country have announced that they will not compound interest and profit rates on their loans during the moratorium period, but mostly only for retail and SME customers.

As of March 31, among the banks are Affin Bank and Affin Islamic Bank, Agrobank, Alliance Bank, AmBank, Bank Islam, Bank Muamalat, Bank Simpanan Nasional, CIMB, Hong Leong Bank, HSBC Bank, Maybank, MBSB Bank, OCBC Bank, Public Bank, RHB Bank, Standard Chartered Bank, SME Bank and UOB Bank.

Hence, borrowers should ask their banks on how payments would resume after the deferment period, as the instalment amount may be higher in future, and to check whether there is an extension of the loan financing tenure.

In conclusion, borrowers must take the trouble to find out from their individual banks exactly what they are in for the post-moratorium period, to ensure they can meet their financial obligations then.

FAQs: For mortgage loan borrowers

Q1: Who is eligible for the deferment package?

All individual loans or financing are eligible excluding credit cards and loans that have more than 90 days in arrears and foreign currency denominated loans.

Q2: Do I need to call the bank for the enrolment? Any documents needed?

The enrolment will be automatic for eligible borrowers, no documents or enrolment phone call needed.

Q3: Can I ask for more than six months deferment?

The deferment is only limited for six months. It’s better for individuals to contact their banks to make special arrangements if they require a deferment of more than six months.

Q4: Will my CCRIS records be affected if I accept the deferment package?

No. However, interest or profit will continue to accrue on loan or financing repayments that are deferred and borrowers will need to honour the deferred repayment in the future.

Q5: Which banks offer this deferment package?

All licensed banks, licensed Islamic banks and prescribed development financial institutions regulated by BNM will offer this deferment flexibility.

Q6: Can I choose to opt out from the deferment package?

Yes. You need to contact your bank if you wish to opt out of the automatic deferment package, or you could continue to make timely repayments of your loan.

Q7: My loan repayment is being automatically deducted from my salary, am I still eligible for the deferment package?

Yes. Please inform your company or bank to stop the salary deduction if you choose to opt in for the loan deferment package.

Q8: If I opt in for the deferment package, can I choose to stop the deferment anytime?

Yes, please inform your bank and continue to make timely repayment of your loan.

Q9: I have a few loans but I only want the repayment deferred for a certain loan, what should I do?

Please contact your bank and inform them about the account that you would like to be excluded from the automatic moratorium.

Q10. Does this deferment package include newly approved or disbursed loans?

Yes. It applies to all loans or financing outstanding as at April 1, 2020.

Q11. What happens to my loan/financing payments after the deferment period? How does being in the deferment package affect my interest payments after the six-month period?

For conventional loans, interest will continue to be charged on the outstanding balance comprising both principal and interest portions (i.e. compounded) during the deferment period. However, some financial institutions may decide not to compound interest during the deferment period. For Islamic financing, profit will continue to accrue on the outstanding principal amount. Such profits however, will not be compounded in line with Shariah principles.

Resuming payments after the deferment period may mean higher subsequent instalments while preserving the original loan/financing tenure, or an extension of the loan/financing tenure after the six-month moratorium period. Please call your financial institutions to check.

Stay calm. Stay at home. Keep updated on the latest news at www.EdgeProp.my #stayathome #flattenthecurve

This story first appeared in the EdgeProp.my pullout on April 3, 2020. You can access back issues here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.