Are some homebuyers in Malaysia paid to borrow and buy?

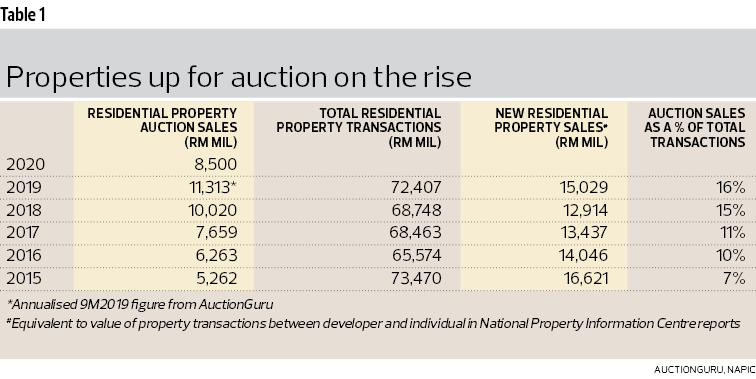

The number of properties going under the hammer in Malaysia has been on a worrying uptrend in recent years (see Table 1). Even if we attribute the sharp increase in 2020 — the figure is effectively only for half a year after taking into account the six-month blanket loan moratorium — to the Covid-19 pandemic, the rising trend has been playing out for far longer.

Residential property transactions (by value) from auctions as a percentage of total transactions have been rising since 2015, doubling by 2018 and reaching nearly 16% in 2019. The numbers are far, far higher than that in neighbouring Singapore.

Put another way, the value of properties ending up in auction — estimated at more than RM11 billion in 2019, up from RM5.3 billion in 2015 — has been growing at a much faster pace compared with annual new property sales, which have been relatively stagnant. (Total value of new property sales is estimated at roughly RM15 billion in 2019, slightly less than the RM16.6 billion in 2015.) Surely something is desperately wrong.

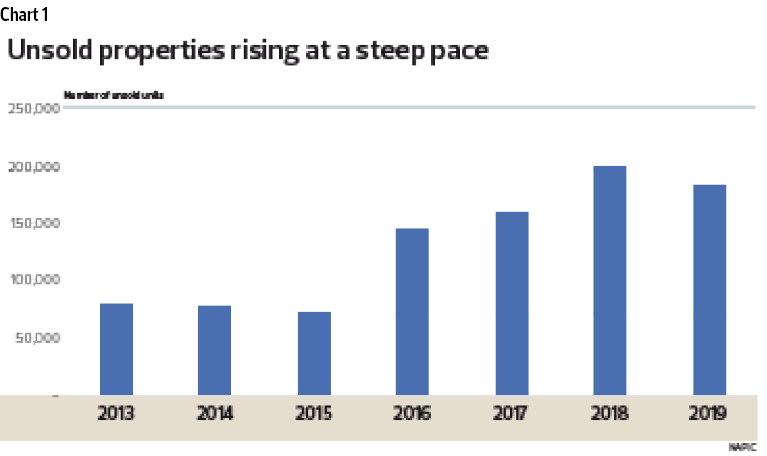

It could be explained, in part, by the fact that the Malaysian property market has been depressed for years — particularly in the secondary market where sales and prices are stagnating, going by property listings. Industry statistics also show a worsening supply glut with unsold units rising steeply (see Chart 1).

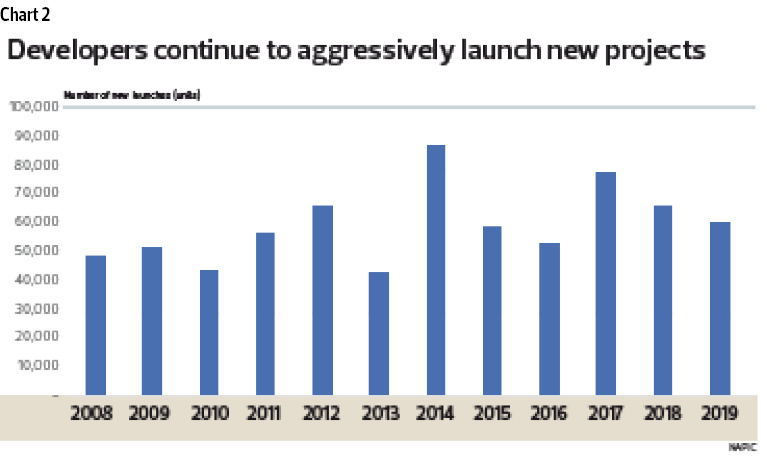

Yet, property developers are still launching a high number of projects — well above the pre-2014 historical averages (see Chart 2). And they are managing to sell at higher and higher prices! On the surface, what an incredible feat.

In short, we have a situation where there is a large overhang of unsold properties but developers are still aggressively launching new projects. Prices are weak in the secondary market, which is reflective of the real underlying property demand, yet strong in the primary market (set by developers). Does this make sense?

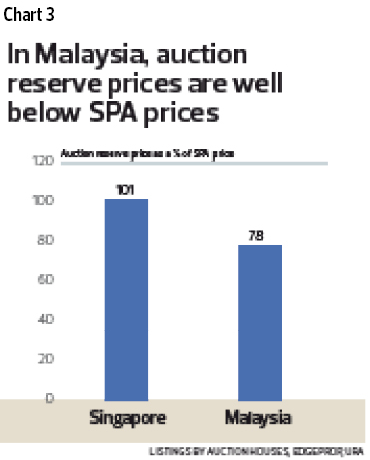

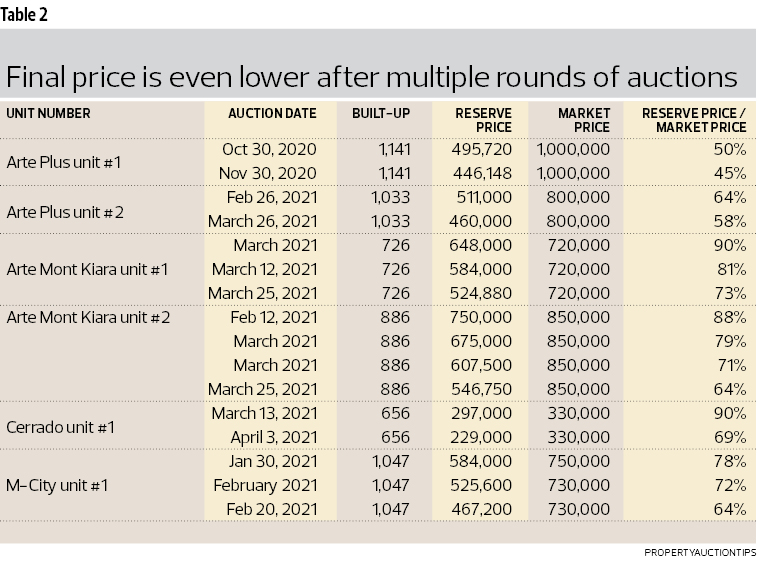

In addition to the rising number of properties ending up in auctions, it is even more troubling that the auction reserve price is just about 78%, on average, of the Sale & Purchase Agreement (SPA) price (based on a sample size of 176 units, with auctions on 87 units still ongoing). Furthermore, most auctions go through multiple rounds before they are completed, meaning that the final hammer price would very likely be even less than 78% of the SPA price. By comparison, the average auction reserve price in Singapore is about 101% of the SPA price (based on a sample size of 173 units, with auctions on 149 units completed [see Chart 3]).

Table 2 lists several examples of recent and ongoing auctions, with the final price going as low as 45% of the prevailing market price. This would imply huge losses for homebuyers and the banks providing the mortgage financing.

What is happening? Why is the number of properties going on auction rising so quickly and why are the final prices so low compared with market prices? And, more importantly, why is this happening?

We think the crux of the issue boils down to, primarily, the lack of data transparency in Malaysia. A case in point: We had a tough time collating data for this article, from various official and unofficial sources; some statistics are only available as snapshots at this current point in time, and even then, limited and incomplete — though the sum of which still manages to tell the story of a growing problem in the country.

The root cause lies in how developers price properties at launch. The SPA price is inflated — above the prevailing market prices for similar units within the vicinity. It is an open secret that some developers then offer discounts-rebates to homebuyers — typically 10% of the SPA price, in some cases much more. In other words, the SPA price is overstated by at least 10%. Why do this?

Mortgages are given based on SPA pricing. For example, buyers can get up to 90% loan on this amount for their first two properties. Therefore, by inflating the SPA price, homebuyers are incentivised to buy because they can now effectively obtain 100% financing. House price = SPA price less 10% discount = total mortgage financing.

Indeed, homebuyers could even come out ahead in terms of cash upfront! If, say, a developer offers 15% rebate and the bank lends 90% of the SPA price, the homebuyer will receive net cash equivalent to 5% of the house price. We know of one case where the developer is giving a 40% discount plus RM45,000 cash. In effect, the buyer gets a house to stay in plus free cash to spend as they choose. What a marketing winner!

Obviously, developers benefit from being able to sell more properties, and at higher than market prices. For sure, there are responsible developers that do not play this game. But the tactic has worked so well for some that it is now quite prevalent, and even evident in secondary market transactions. Real estate agents encourage buyers and sellers to agree on inflated SPA prices to facilitate sales — and earn more fees on higher SPA values to boot. Even the government gains from collecting more stamp revenue on higher SPA values.

By continuing to base mortgages on SPA — despite knowledge of deep developer discounts-rebates and inflated SPA prices — property valuers and banks are also complicit in perpetuating the environment of artificially high property prices. Why?

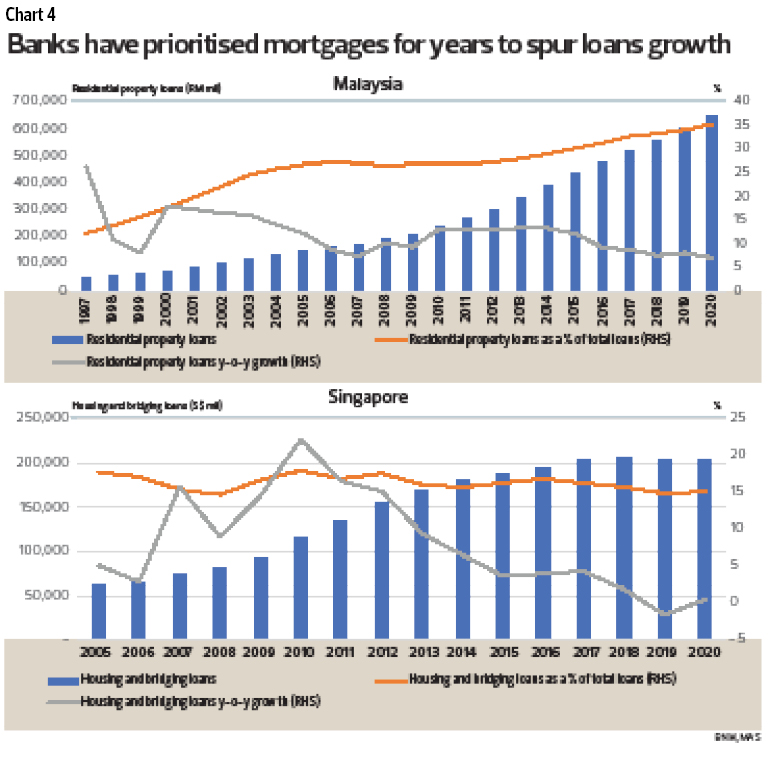

The bank officers are able to meet their targets by successfully giving out mortgages and banks get to grow their loan portfolios, on the assumption that they remain relatively safe collaterised loans (which is increasingly not the case [see Chart 4 on Page 18]).

Artificially inflating property prices makes homes less affordable than they should be

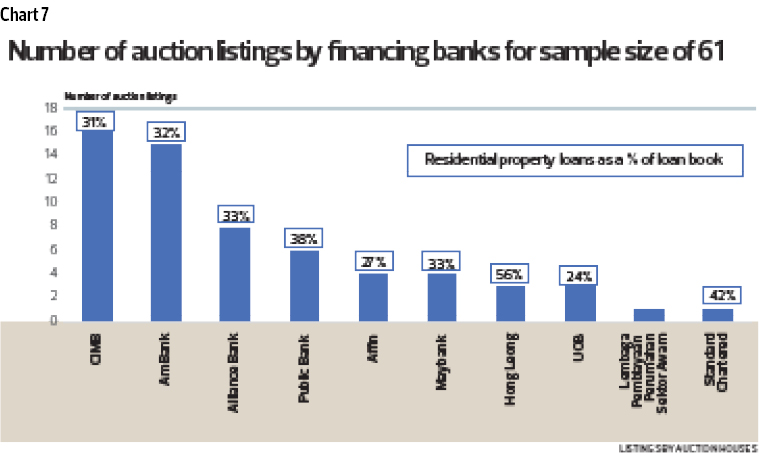

Banks have prioritised growing their mortgage business for years. As a result, residential loans as a percentage of total loans have been rising consistently over the past decade. Even in the last few years, year-on-year growth has hovered around 8%. In contrast, in Singapore y-o-y loan growth fell into negative territory in 2019 and was only marginally positive last year. Total value of mortgages has flattened out and mortgage as a percentage of total loans has remained stable at around 16%. In Malaysia, this ratio has risen each year since 2008, to almost 35% currently from 26.5%.

This is as much a reflection of the inability of Malaysian banks to steer their lending to the more productive sectors of the economy, which is increasingly needed to create jobs and to increase efficiency and productivity.

It appears to be a win-win-win situation for all — but it is not. In fact, we think persistent weakness in the property market is a symptom of this deeper malaise.

By inflating property prices, buyers will not be aware of the real underlying market prices. Artificially high property prices make homes even less affordable than they should be. Worse, homebuyers would inadvertently be overpaying for their homes.

It becomes worse when such practices encourage excessive property speculation by certain groups of people. If one is able to effectively get 100% financing to punt on properties, it means zero upfront cost and handsome returns (owing to the leverage effect) from flipping the properties when prices go up, which developers tacitly promise to do with each subsequent new launch. Such speculation will only serve to drive up overall property prices, taking homes beyond the reach of genuine homebuyers.

Artificially keeping prices high also prevents the market from adjusting to the underlying demand-supply situation. Under normal circumstances of excess supply, prices must fall to re-establish a new equilibrium, from which demand and prices can then rebound. Without this market clearing ability, the market simply stays sluggish — as it has for some years now.

Only one party can stop this charade

There is a reason why buyers are required to put at least 10% equity on homes — so that banks have a buffer if buyers default and/or property prices drop. As mentioned, auction prices in Malaysia are significantly below SPA prices. If the bulk of the loss has to be absorbed by the financing banks, there would be a wider fallout, beyond the individual homeowner. At best, it translates into higher non-performing loans (NPLs) and additional capital requirements, penalising shareholders. At worst, rising losses could pose a systemic risk to the overall banking system, jeopardising the country’s growth and ultimately burdening the people. Make no mistake, higher NPLs at banks force interest rates on all borrowers to go up.

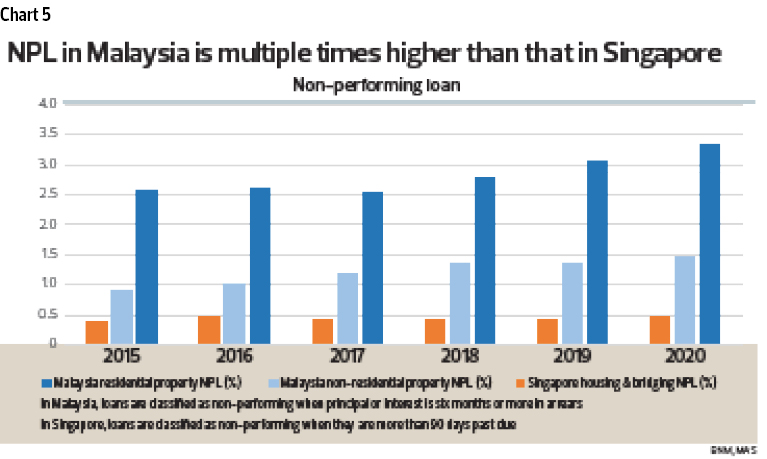

Residential property NPLs in Malaysia are rising, from an average of 2.6% in 2015 to 3.3% in 2020 while that for non-residential property has risen from 0.9% to 1.5% over the same period. In contrast, NPLs for housing and bridging loans in Singapore have held steady at 0.4% to 0.5% through the same period — and this is on a more stringent criterion of 90 days past due compared with six months in Malaysia (see Chart 5).

In Singapore, all licensed developers are required by law to submit on a weekly basis purchase and net prices (after deducting all benefits offered, including rebates, discounts, reimbursements such as legal and stamp fees, furniture vouchers, non-monetary benefits and so on) of units sold.

At the same time, the Monetary Authority of Singapore requires financing institutions to base the loan amount on the residential property’s net purchase price — after deducting any discounts, rebates and other benefits. Meanwhile, estate agents failing to make full disclosures of all material facts in transactions such as discounts are liable for hefty fines or imprisonment.

These measures, in combination, work to ensure full transparency in property pricing. The data is collated, available and easily accessible to all stakeholders, including homebuyers, valuers and banks, enabling them to make decisions based on complete information. The result is self-evident. A case in point: The average auction reserve price in Singapore is about 101% of the SPA price — meaning limited losses for both homeowners and banks, even in the worst-case scenarios.

In conclusion, the act of inflating property prices is prevalent in Malaysia. It is a game that has been allowed to go on for far too long. But it has longer-term costs. Inflated property prices make homes increasingly unaffordable, lead to misallocation of resources and pose a systemic risk to the banking system. If the issue is in homebuyers not being able to come up with the 10% down payment to close the transaction, then let the issue surface. Find a real solution that does not game the system.

Is it not time for Malaysia to establish and enforce a transparent pricing framework and make all the data publicly available, for the protection of all, including genuine homebuyers, responsible developers and the banking system? Is it not time to make homes more affordable for genuine Malaysian homebuyers? Only one party can end the charade and we hope they will do something.

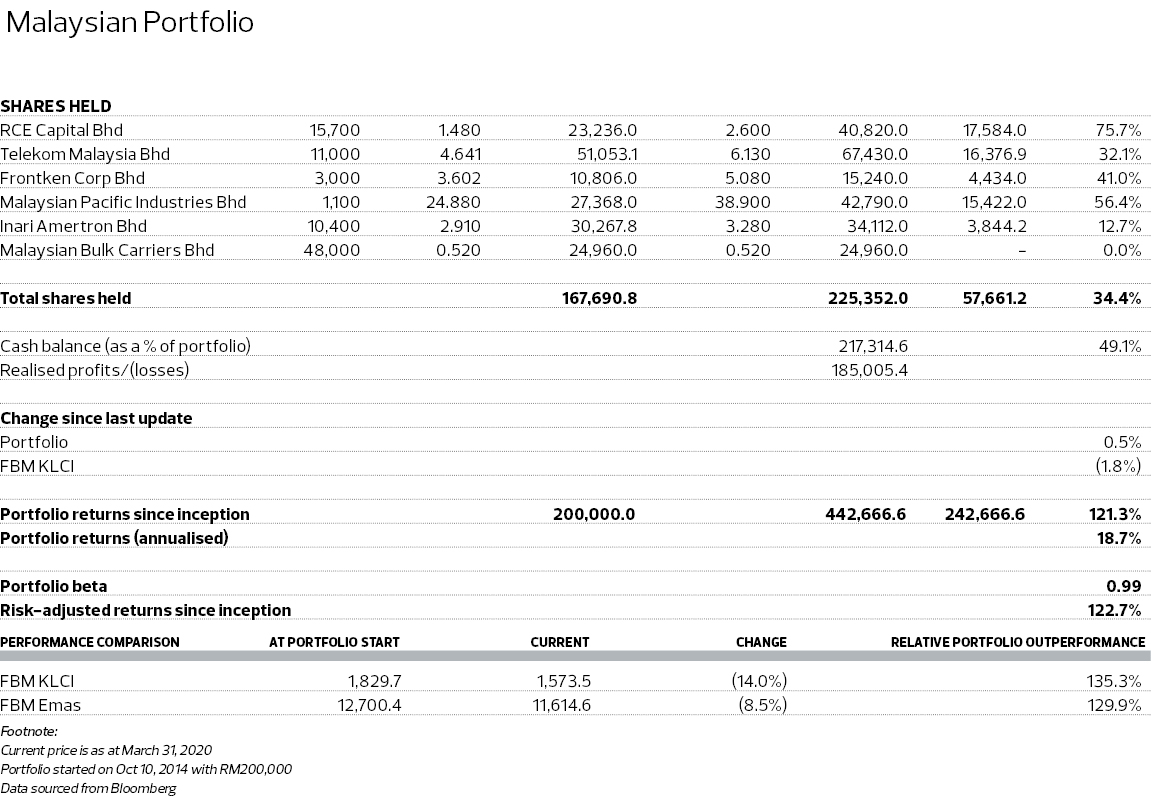

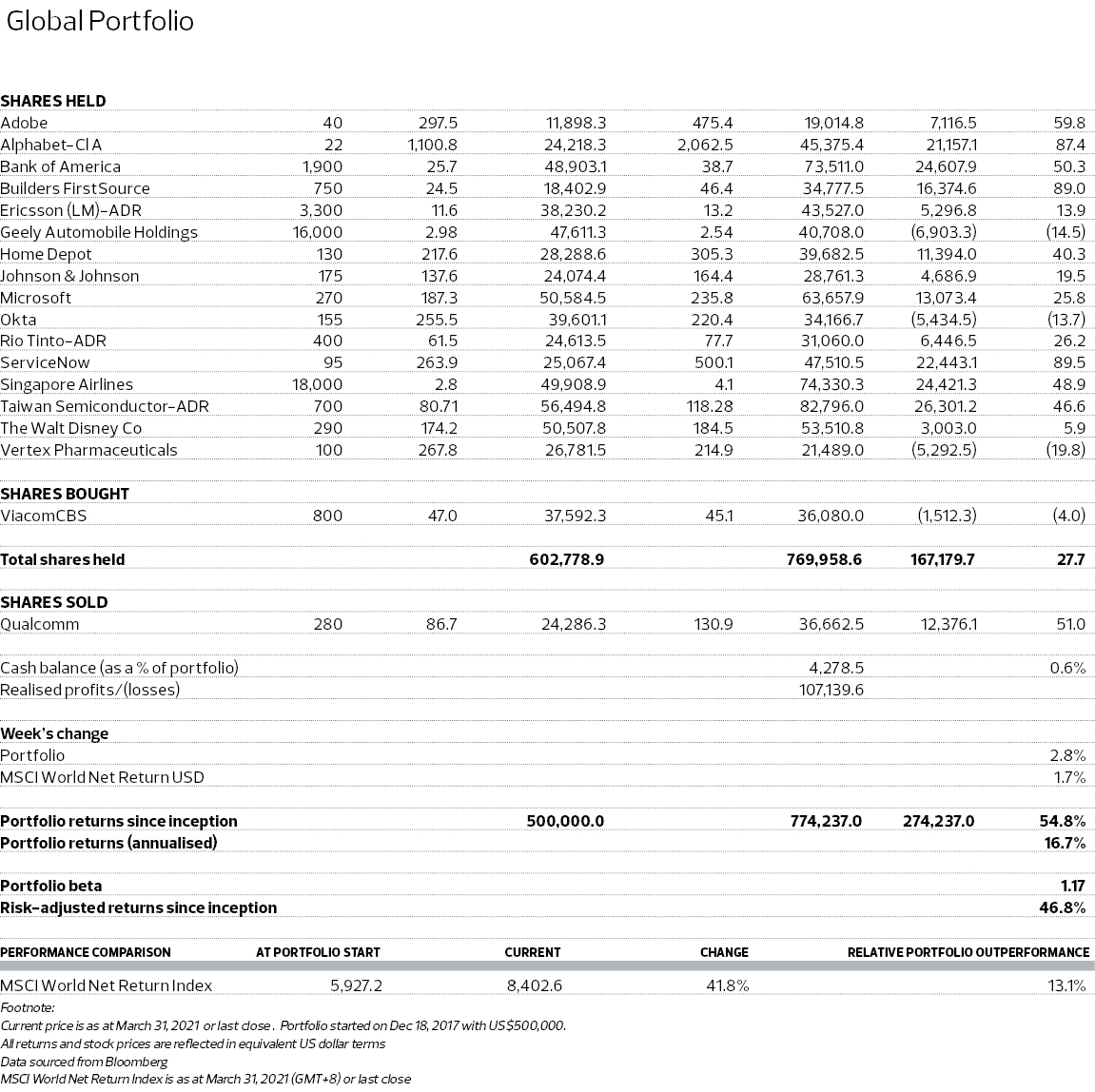

The Global Portfolio closed 2.8% higher for the week ended March 31, lifting total returns to 54.8% since inception. The portfolio is outperforming the MSCI World Net Return index, which is up 41.8% over the same period.

Top gainers last week were Builders FirstSource (+8.4%), Bank of America (+5.7%) and Taiwan Semiconductor Manufacturing Co (+5.6%). Only two stocks ended lower — Okta (-2.3%) and Microsoft (-1.5%).

The Malaysian Portfolio also gained last week, rising 0.5% and outperforming the FBM KLCI, which fell 1.8%. Total portfolio returns now stand at 121.3% since inception. This portfolio is outperforming the benchmark FBM KLCI, which is down 14%, by a long, long way.

Disclaimer: This is a personal portfolio for information purposes only and does not constitute a recommendation or solicitation or expression of views to influence readers to buy/sell stocks. Our shareholders, directors and employees may have positions in or may be materially interested in any of the stocks. We may also have or have had dealings with or may provide or have provided content services to the companies mentioned in the reports.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.