Analysts maintain 'buy' calls on Gamuda as 3Q earnings meet expectations, expect more job wins

- Quarterly net profit edged up 0.85% to RM223.36 million from RM221.49 million a year earlier, on the back of stronger overseas construction earnings. Revenue climbed 81.22% to RM2.07 billion from RM1.14 billion last year, with overseas revenue tripling.

- Earnings per share came in at 8.40 sen against 8.72 sen for 3QFY2022, the group showed in a bourse filing on Thursday (June 22).

KUALA LUMPUR (June 23): Analysts have kept their "buy" calls on Gamuda Bhd, following its results for the third financial quarter ended April 30, 2023 (3QFY2023), which largely met expectations.

Quarterly net profit edged up 0.85% to RM223.36 million from RM221.49 million a year earlier, on the back of stronger overseas construction earnings. Revenue climbed 81.22% to RM2.07 billion from RM1.14 billion last year, with overseas revenue tripling. Earnings per share came in at 8.40 sen against 8.72 sen for 3QFY2022, the group showed in a bourse filing on Thursday (June 22).

In a separate filing, Gamuda announced the start of Phase 1 of its reclamation works, worth RM3.72 billion, on the Penang South Island (PSI) project, which is expected to be completed by June 30, 2030. This brought its construction order book to RM21.5 billion as of April 30.

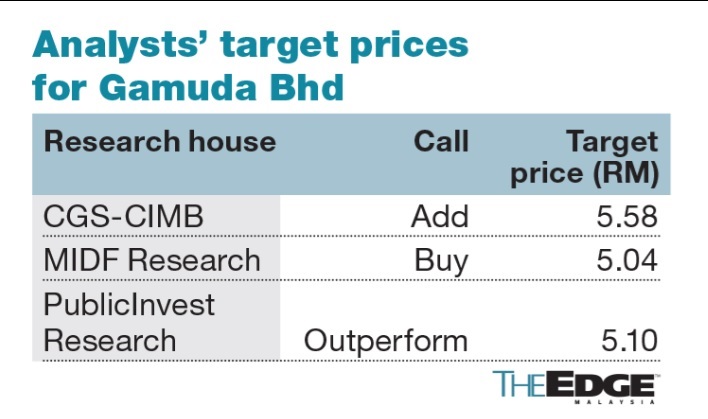

In a research note later in the day, CGS-CIMB welcomed the slew of good news for Gamuda, maintaining its "add" call and target price (TP) of RM5.58. It said the group even targets to double its order book in the next two to three years (adding RM12 billion per annum for FY2024-25), though CGS-CIMB's forecast is an addition of RM10 billion per year for the same period.

This is on the back of the government's commitment to funding the Light Rail Transit (LRT) in Penang, with works expected to commence by year end. Mass Rapid Transit (MRT) 3 tender validity has also been extended from March 31 to Sept 30, and awards are possible by year end, post state election, according to Gamuda in an analyst briefing. Looking abroad, its most immediate project in Australia pending an award is the Suburban Rail Loop East in Victoria (expected by the third quarter of calendar year 2023).

Meanwhile, MIDF Research, which kept its "buy" rating and TP of RM5.04, also sees Gamuda's construction order book of RM21.5 billion as outstanding, providing earnings visibility up to FY2026/27.

The research house in a note on Friday remained strongly optimistic about Gamuda's earnings outlook, backed by its strong overseas presence, which is now contributing almost half of its bottom line, as Australian projects make up the bulk of its order book at RM12.4 billion (57.7%).

Gamuda is also set to make greater strides in Australia, where it has just completed the acquisition of Downer Transport Projects, a division of Downer Group specialising in rail, according to MIDF.

Gamuda is also MIDF's top pick for the construction sector. Following founder Datuk Lin Yun Ling's contract renewal to stay as the group managing director until June 30, 2028, MIDF found reassurance in the group's succession planning with its current pool of younger generation leaders.

Upside and downside risks

Both CGS-CIMB and MIDF found Gamuda's cumulative nine-month core net profit (9MFY2023) of RM608 million to be in line with their expectations but above consensus estimates.

A third research house, PublicInvest Research, too maintained its "outperform" call on Gamuda, with an unchanged TP of RM5.10, in a note on Friday. For the PSI project, it has an estimated value of RM4 billion to RM4.5 billion for Gamuda's job, as the reclamation works awarded had not included common infrastructure works that could go up to RM1 billion in value. Including the latest job win, the group has achieved RM10.6 billion or 70.7% of PublicInvest's FY2023 order book replenishment assumption of RM15 billion.

For CGS-CIMB, a key rerating catalyst is Gamuda's ability to deliver high single-digit pre-tax margins for its Australian infrastructure projects. This happened in 3QFY2023, and should it pick up further pace, it would instil more confidence in the group's ability to execute projects Down Under. Key downside risks, meanwhile, are potential labour issues in Australia, which would derail its construction progress there, and delays in job awards.

At the time of writing on Friday, Gamuda was 15 sen or 3.53% higher at RM4.40, giving it a market capitalisation of RM11.71 billion. Year to date, it had risen by 16.4% from RM3.78 on Jan 3.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.