Project awards yet to translate into orders for SCH Group

SCH Group Bhd (July 28, 21 sen)

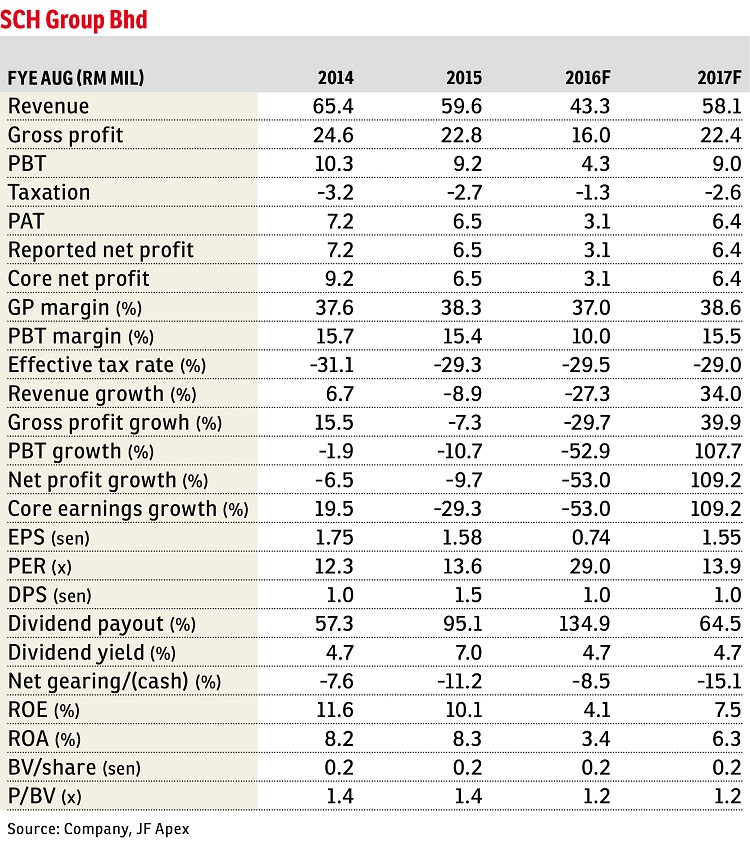

Maintain hold with an unchanged target price of 20 sen: SCH Group Bhd registered third quarter of financial year 2016 (3QFY16) net profit of RM700,000, soaring six-fold quarter-on-quarter (q-o-q), but down 66.7% year-on-year (y-o-y). Its nine months of FY16 (9MFY16) results with net earnings of RM2 million, down 72.2% y-o-y, were below our estimates, accounting for 37% of our FY16 forecast. This was due to continuous weak sales as a few project awards for the Mass Rapid Transit 2 (MRT2) and Pan Borneo Highway in the first half of 2016 had yet to translate into strong orders for quarry machinery and equipment (M&E).

As expected, the group achieved higher q-o-q results, mainly due to a low base effect. 2QFY16 was a weaker quarter, with shorter operation days of quarry production, affected by long festive holidays in December and February.

On a y-o-y basis, SCH continued to chalk up a lower y-o-y net profit for 3QFY16, no thanks to lacklustre sales (-45.3% y-o-y), coupled with proportionately higher administrative expenses (its profit before tax [PBT] margin was down by 6.9 percentage points). Sluggishness in sales was mainly due to quarry M&E, which tumbled 84% y-o-y. Likewise, the group’s 9MFY16 revenue (-41.6% y-o-y) and net earnings (-72.2% y-o-y) were also weighed down by across-the-board lower customer orders for quarry M&E (-70%), quarry industrial products and spare parts (-31%), and manufacturing of grills (-28%).

The group has received some small orders from clients since operation commenced in the second quarter of calendar year 2016 (2QCY16). Sales mainly came from the supply of quarry industrial products and servicing of quarry machinery. However, we do not foresee any major contribution from its overseas operation in the near term.

We reckon that the worst is over for the group, with an improving operating environment — a diminishing impact of the goods and services tax, and the rebound of the ringgit against major currencies since early this year. With the awards of MRT2 and Pan Borneo Highway to contractors in the first half of CY16, quarry operators would ultimately ramp up their capital expenditure and operating expenditure to cope with rising demand for building material, and hence benefiting SCH.

We slash our net earnings forecast for FY16, from RM5.4 million to RM3.1 million, by reducing our sales order forecast for its M&E and its PBT margin. However, we maintain our FY17 estimates.

Our fair value for SCH is pegged at 13 times FY17 forecast price-earnings ratio (PER). This is equivalent to the peak PER of small-cap stocks, in view of the prevailing construction boom which is expected to benefit the quarry sector.

Although the group has posted unexciting earnings for FY16, we reckon that the stock renders minimal downside risk to investors, while waiting for the take-off of several infrastructure and construction projects to translate into meaningful orders. — JF Apex Securities, July 28

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on July 29, 2016. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.