What shall we do with the property overhang?

It could be one of the most bizarre situations in the housing industry. On one hand we have many people who find it difficult to own a home, while on the other hand we have completed but unsold homes piling up in the market. The Malaysian property sector has been nursing a hangover over the property overhang.

Defined as units that have received their Certificate of Completion and Compliance but remain unsold for more than nine months after launch, the number of these overhang units is growing like a rolling snowball.

Based on data from the National Property Information Centre’s (Napic) Unsold Property Enquiry System Malaysia (UPESM), there was an overhang of 50,008 overhang residential units worth some RM33.96 billion in the country as at the third quarter of 2019 (3Q2019). They include both residential- and commercial-titled housing, namely terraced homes, detached houses, apartments, condominiums, serviced apartments and Small-office Home-offices (SoHos).

Of the total, the non-landed sub-sector tops the list with serviced apartments (17,459 units) as well as apartments and condominiums (13,630 units) taking up more than 60%.

In 1Q2017, there were 22,175 overhang homes worth RM13.27 billion, which means, based on the 3Q2019 figure, the overhang has increased by a massive 126% in volume and 156% in value in just two-and-a-half years.

However, there was a slight dip from the previous quarter (52,568 units worth RM34.99 billion as at 2Q2019) by about 5.12% in volume and 2.94% in value.

This can be attributed to the Home Ownership Campaign (HOC) which helped to clear some of the unsold stock in the market, says Real Estate and Housing Developers’ Association Malaysia (Rehda) president Datuk Soam Heng Choon.

According to the Ministry of Housing and Local Government’s (KPKT) Achievement Report Card, the year-long campaign achieved sales of 29,461 units worth RM17.99 billion comprising both completed and under construction residential units.

“The HOC has been a success with transactions exceeding expectations. These transactions will definitely go a long way to clear existing overhang as well as reduce potential overhang,” Soam tells EdgeProp.my.

The overhang and unsold property issue is not to be taken lightly. Real estate consultancy CBRE|WTW managing director Foo Gee Jen describes the current situation as “worrying”, considering the sizeable volume of unsold units that are being built and those yet to commence construction.

According to the UPESM data, overall, there were 112,244 units and 25,114 units of unsold property under construction and unsold unconstructed property as at 3Q2019 respectively, worth more than RM23 billion in total.

If the issue remains unsolved, it could even affect Malaysia’s economic growth, Foo adds.

“When you have more than RM30 billion stuck there, it does not help the economy as the unproductive capital tied up in the unsold units is not creating any rolling economic effect while impacting the nearly 150 industries that are related to the real estate sector,” he says.

So what can we do about it and what is the root cause? Let’s get the lowdown from several established industry players.

Factors that led to the overhang

1 House prices rose beyond the affordability level

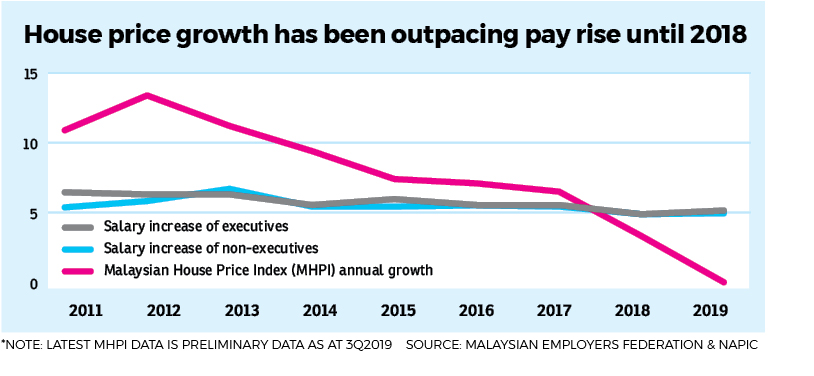

According to Perbadanan PR1MA Malaysia chairman and MKH Bhd managing director Tan Sri Eddy Chen, the substantial growth in house prices is a key factor that contributed to the high number of overhang.

He recalls that Malaysia’s recovery from the sub-prime mortgage crisis which took place during 2007 to 2010 was sharp and prices started to escalate from 2011 to 2015, causing house prices to increase by as much as 15% per annum.

“The growth [of as high as 15%] was clearly unsustainable,” he says.

Meanwhile, Bandar Utama City Centre Sdn Bhd director Tan Sri Teo Chiang Kok believes the escalating cost of doing business and construction faced by developers contributed to higher house prices.

“Due to the rising cost of compliance, cost of doing business, long approval process and the down cycle of the economy, affordability and confidence were eroded thus resulting in less demand,” says Teo.

2 High cost of living and stagnant income growth

The depreciation of the Malaysian ringgit and the implementation of the Goods and Services Tax over the last four to five years have caused prices of essential goods to spike and inflated the cost of living while income growth has been stagnant for the low- and middle-income groups.

“All these hit the M40 and B40 group harder than others. The high cost of living has a big impact on the people’s ability to save enough for deposit, and hence ability to afford a house, especially in the M40 group. Hence, the largest segment of overhang comprised mid-range homes,” says Chen.

3 Cooling measures

The cooling measures introduced by the government also came into play, including measures such as the reintroduction of the Real Property Gains Tax, a maximum loan-to-value ratio of 70% for a third housing loan, removal of the Developers Interest Bearing Scheme and the more stringent loan approvals by banks.

This, according to Henry Butcher Malaysia chief operating officer Tang Chee Meng, has dampened buying sentiments as the more stringent criteria adopted by banks and lower margins offered deterred consumers from buying property.

4 Supply-demand mismatch

The overhang could also be attributed to the supply-demand mismatch in some locations. Many are situated in unfavoured places or are considered unaffordable. Some units were also developed in areas where there is already an oversupply of similar properties, Tang says, citing Johor as an example.

“Some of the projects may be located in areas which are not deemed suitable or ideal by the targeted buyers due to lack of amenities or public transport; or they are too far away from the buyers’ place of work,” he elaborates.

5 Lack of timely and accurate data

Some industry players believe the absence of timely and accurate data for developers caused the mismatch, says Rehda’s Soam.

Without the right data, it is a guessing game that hinders developers from providing the “right types of properties at the right location and at the right price”. Houses continue to be developed in areas that do not require them while there is a lack of housing available in locations that require more.

“Information inequality also gave developers false optimism to persistently build especially high-rise residences during the boom back in 2013/2014 at prices, locations and sizes that failed to match market demand.

“These [properties] subsequently became overhang units when they were completed three to four years later,” says CBRE|WTW’s Foo.

Meanwhile, Rehda continues to call for an integrated housing database to be spearheaded and coordinated by KPKT to consolidate data from multiple agencies at federal, state and local levels as this will help in the planning and allocation of residential units in the country, especially affordable housing.

“By making the data accessible to all industry players, a better understanding on how new launches perform and developers can make informed decisions with regards to their products in terms of pricing, location and timing,” says Soam.

6 Property boom lost its steam

The property boom that began in 2008 has exhausted its steam after it inflated beyond demand, says the Institute for Democracy and Economic Affairs (IDEAS) senior fellow Dr Carmelo Ferlito.

“At the beginning, the flow of investments in the property segment was justified by the demand dynamic. The positive mood awakened by the initial profitable projects attracted second-comers and then the boom inflated beyond the demand structure,” he says.

“Homeownership in Malaysia is high, hitting 76.3% in 2016. Secondly, investors have realised that the era of impressive returns, typical of a nation transitioning from developing to developed status, is over.

“Therefore, not only is demand for direct consumption not supporting the market but speculative demand has also lost steam,” Ferlito explains.

What we can do

Reduce prices

According to CBRE|WTW’s Foo, all stakeholders need to play their part to address the issue.

“Developers for instance, will have to be more realistic with their sales targets because the bull-run that happened during the period of 2010 to 2014 is over.”

With regards to unsold units especially those in unpopular locations or that are over-priced, developers should consider reducing the price and even sell them at a loss, he says.

Rent them out

It is perhaps timely for the government to consider mopping up vacant, unsold units and renting them out as transit homes as seen in many developed countries.

“If the economy is going to stagnate, the rental market would be the way forward for many. This may save the government billions of ringgit in building new houses and competing with private developers. Instead, it could complement the latter in providing affordable rental homes,” offers Soam.

Henry Butcher’s Tang shares a similar view.

“If the supply of affordable homes rises, it would be even tougher for developers to clear the old stock of unsold houses,” says Tang.

Having said that, he adds that in any case, the unsold stock will still not gain buyers and developers will still struggle to sell if the project location and pricing are not what the market wants in the first place.

More careful planning

Independent and thorough market research should be carried out to assess the viability of a new project before they are implemented. This would include identifying trends to formulate the right development mix and offerings that meet buyers’ preference, says Tang.

“Developers will have to study the local dynamics in the chosen market and focus on the segment that has strong demand. For example, the demand patterns or consumer preferences and affordability levels in Alor Setar will be very different from that in Kuala Lumpur and Johor Bahru,” he explains.

CBRE|WTW’s Foo says developers should also look at the local context when pricing their products rather than take a one-price-fits-all approach.

He points out that many of the overhang units constitute those priced at the affordable level.

“This raises the question of affordability which may have to be determined in a local context rather than based on a national standard. Otherwise, the mismatch of supposedly affordable units in terms of their pricing and the income level of the targeted buyers will continue.

According to UPESM’s data, of the 50,008 overhang units as at 3Q2019, about 47% are priced at RM500,000 and below while the balance 53% are priced from RM500,001 to more than RM1 million.

Adjust lending policy

Relaxing loan approval guidelines could assist more buyers or give more opportunities for people to buy their dream homes, says Tang.

However, this has to be tampered with prudent practices to curb non-performing loans and to prevent a property bubble.

However, IDEAS’ Ferlito begs to differ.

“Let market forces take their course as the best way to help improve the situation is to avoid supporting the market in artificial ways like using methods that support a demand that is structurally not there.

“This means avoiding credit support. Going forward, it is important to keep the credit system on a conservative stream to avoid artificially supporting a boom,” he says.

Bandar Utama’s Teo opines that while it is prudent to control those with large debts, he advocates that the responsible lending guidelines be left to the lenders and bankers who “know their customers”, to make their lending decisions rather than a blanket guideline that impacts everyone in the market.

“This has aggravated a slowing property market, making seasoned investors take a wait-and-see stance as well,” he says.

Stimulate the economy

Teo believes that ultimately, the economy must first recover in order to absorb the overhang.

“There are many low-hanging fruits that can expeditiously turnaround enterprises and the economy.

“For example, the tourism industry can be revved up quickly. We can adopt a more welcoming stance from easy visa applications to friendly immigration policies and personnel and more promotions especially with this year being Visit Malaysia Year,” he says.

He adds that reduction of red tape; genuine consultations with stakeholders to remove obstacles to investments; and the recovery of under-performing enterprises can also turnaround the economy and create the wealth and confidence in investing in big-ticket items especially properties.

This story first appeared in the EdgeProp.my pullout on Jan 31, 2020. You can access back issues here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.