Home sharing requires regulation, says Budget Hotel Association

HOME sharing, such as through Airbnb and HomeAway, is gaining popularity as an avenue of income for property owners, especially those looking to gain some returns on their investments but do not want to lease their property for the long term.

Although the home-sharing concept could be a means for property owners to make some money from their properties, many issues concerning the safety and legal aspects have arisen as home sharing becomes a norm worldwide.

Some cities such as Berlin, New York and Tokyo are prohibiting owners from renting out their units or rooms as short-term accommodation.

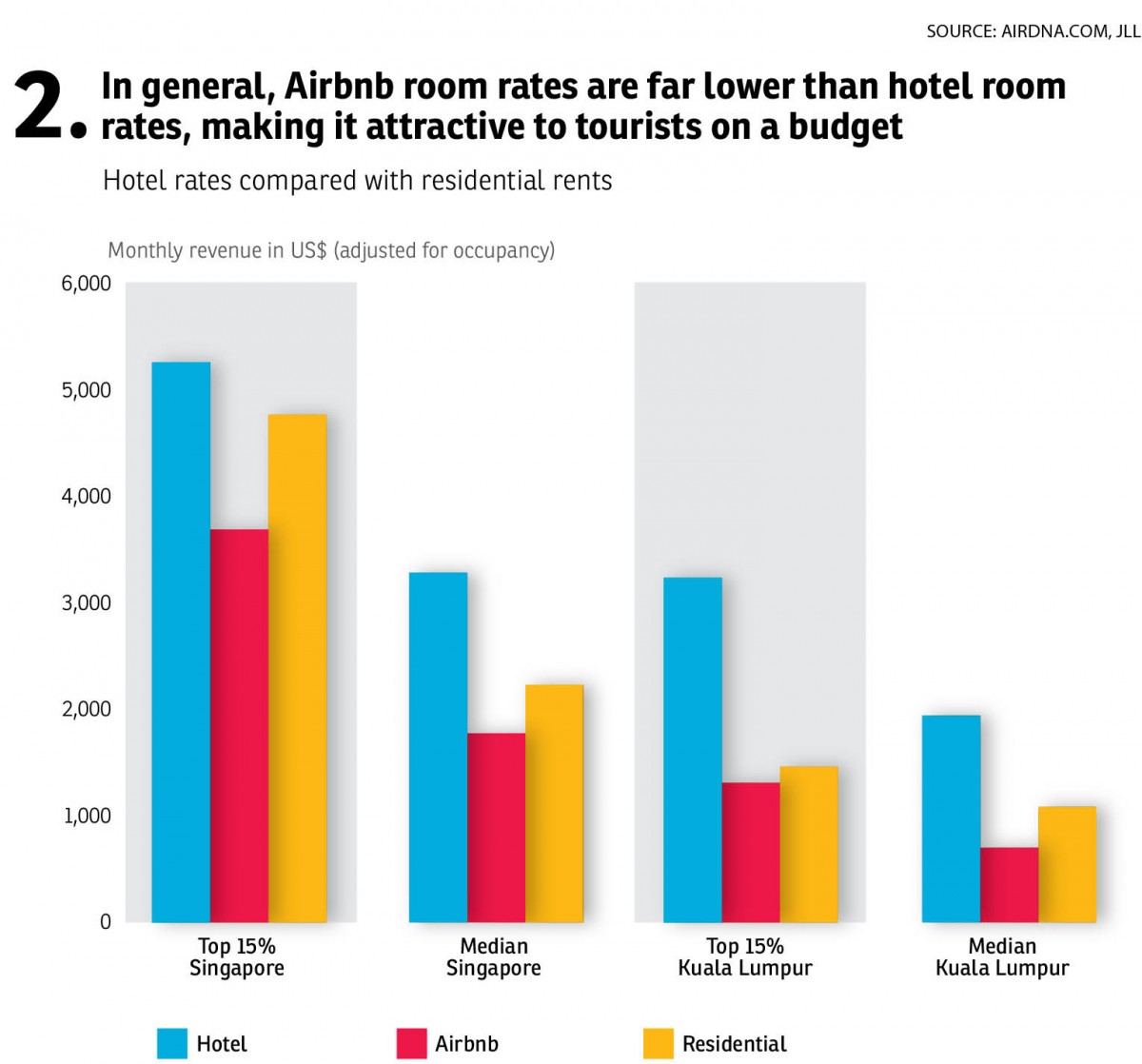

Apart from safety and legal issues, the home-sharing concept is said to be competing with budget hoteliers, putting them in an unfair situation in terms of pricing because unlike the home-sharing business owner, hotels have to comply with certain guidelines imposed by the authorities.

Malaysia Budget Hotel Association (MyBHA) president PK Leong says home-sharing platforms like Airbnb and HomeAway are directly competing with local budget hotel operators as most accommodation offered under home sharing have similar rates as the budget hotels.

“There is no specific law that states home-sharing platforms are prohibited but there are laws that say that commercial activities are banned from being carried out in residential properties,” he tells TheEdgeProperty.com.

He notes that home-sharing platforms could offer better rates as they are not regulated. For instance, they do not have to pay for any licence or other compliance costs — such as safety facilities and inspection, utilities for common areas and the reception area, and company tax as well as the Goods and Services Tax (GST). This allows them to give very competitive rates.

“It’s unfair to compare our [budget hotel] pricing with those being offered on home-sharing platforms as we have a different cost structure,” he says.

According to Leong, Malaysia currently has about 6,000 budget hoteliers and, among them, 2,000 are MyBHA members.

Despite the attractive pricing, Leong emphasises that safety and quality service are usually the main concerns with home-sharing platform customers, especially foreign tourists who are not familiar with Malaysia.

“Transactions over home-sharing platforms are mostly done through online payments. When the customers arrive, they can pick up the key to the accommodation from a certain pre-determined place. There is usually no such thing as reception or housekeeping services,” he explains.

However, he does not oppose the home-sharing business but wants the authorities to look into safety issues and regulate these businesses.

“If property owners are offering short-stay accommodation to customers, they should be regulated and comply with safety requirements just as budget hoteliers have to. It’s not just to ensure a fair playing ground for all, but also to ensure customers’ safety,” he adds.

JLL Malaysia managing director YY Lau says instead of banning home-sharing platforms such as Airbnb, it will be beneficial for everyone if the industry can be controlled through regulations or by licensing them.

“This will give the operators better clarity on the way they should operate their business. Guests too would be better protected,” she adds.

She notes that home sharing has become a popular option for tourists looking for accommodation as it offers a different experience for tourists who want to know more about the local culture.

“Other than the cheaper room rates, another reason is that home sharing gives the guests an opportunity to make friends from different countries. It is the same concept with guesthouses where backpackers get to interact with those from different parts of the world by sharing common facilities,” she explains.

Besides, she says, with home sharing, travellers will no longer be restricted to travel only to places where hotels are available. Instead, they are now able to choose to stay in off-the-beaten-track locations.

Slow growth in Malaysia

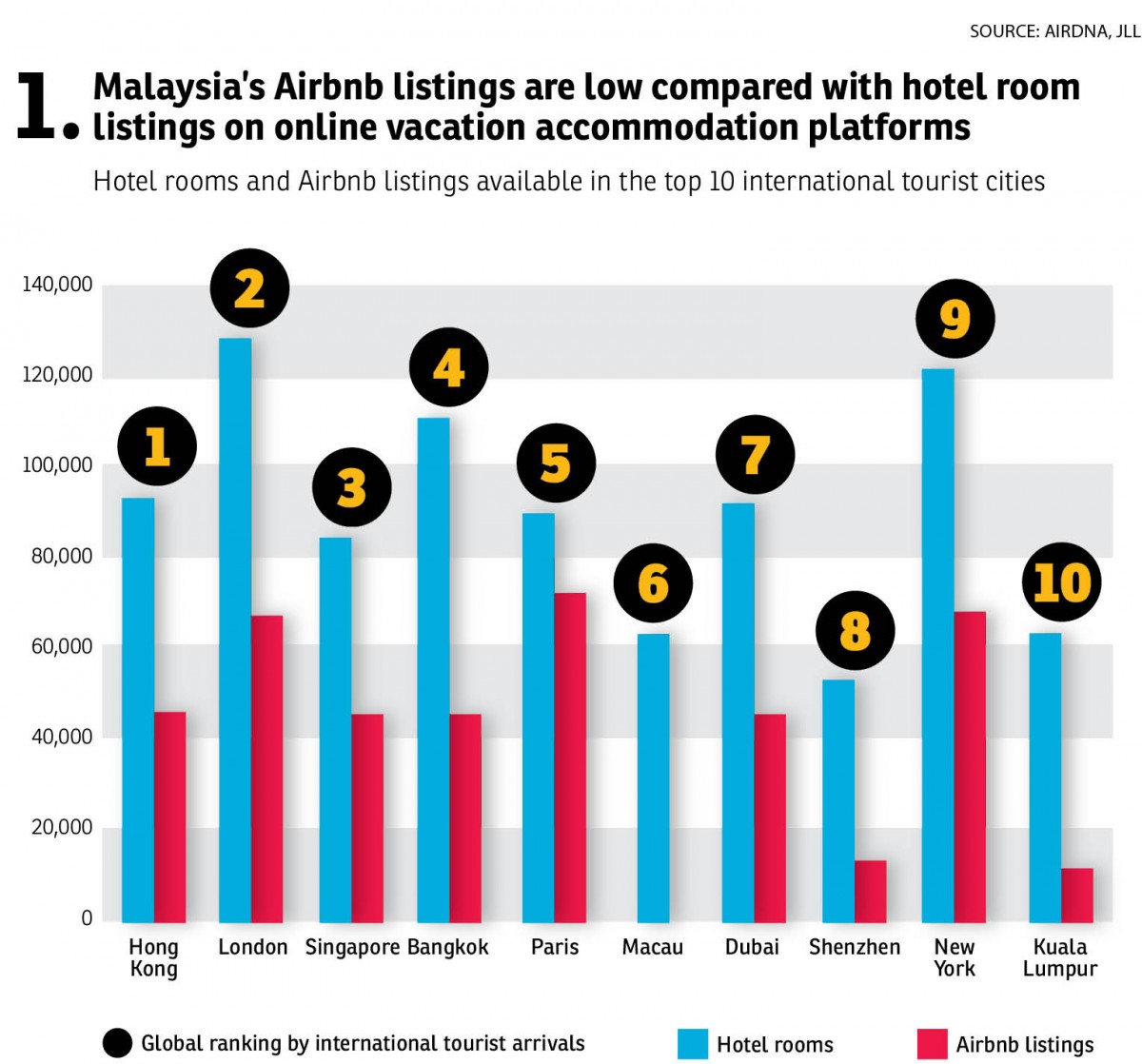

A recent report by JLL states that home-sharing platforms such as Airbnb and HomeAway now account for about 10% of occupied room nights in global gateway cities.

According to the property consultation firm, the trend of home sharing could grow to 15% by 2020 in the mature markets with high international tourist arrivals. Hence, the impact on hotel room rates is beginning to be felt.

In the report “The Fourth Industrial Revolution: The Impact on Real Estate in Southeast Asia” published in June 2016, JLL discussed how technological advances are creating new opportunities for property owners to share their space for short-stay rental.

Cities with the largest tourist arrivals in Southeast Asia, such as Singapore, Bangkok and Kuala Lumpur, have received about 45 million international arrivals annually.

However, home sharing only makes up about 2% of the occupied room nights. Nevertheless, JLL expects the percentage to grow to 5% by 2020.

The impact on hotel room rates may be felt only after 2020 in Singapore, Bangkok and Kuala Lumpur, as currently Airbnb listings make up only 5% of the total room inventory, and potentially just 2% of occupied room nights.

The report’s vacation accommodation listings data showed that Malaysia’s home-sharing growth still lags far behind countries such as Hong Kong, Singapore and Thailand, as annual Airbnb listings are less than 20,000.

“However, we expect the number of listings to grow to 15% of total inventory by 2020,” said JLL in the report.

Lau said the issue of trust is the key to the growth of the home-sharing concept.

“It is true that Airbnb’s growth in Malaysia still lags far behind other main tourist spots and we think one of the reasons for this is because Malaysia has a very small number of owners renting out their units for homestay compared to other countries.

“However, when people start to gain more trust with Airbnb, demand will increase. We believe there will be more operators entering the market to try to make a profit from this emerging business,” she concludes.

This story first appeared in TheEdgeProperty.com pullout on Sept 9, 2016, which comes with The Edge Financial Daily every Friday. Download TheEdgeProperty.com pullout here for free.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.