Mah Sing focuses on resilient central region

Mah Sing Group Bhd (Sept 15, RM1.59)

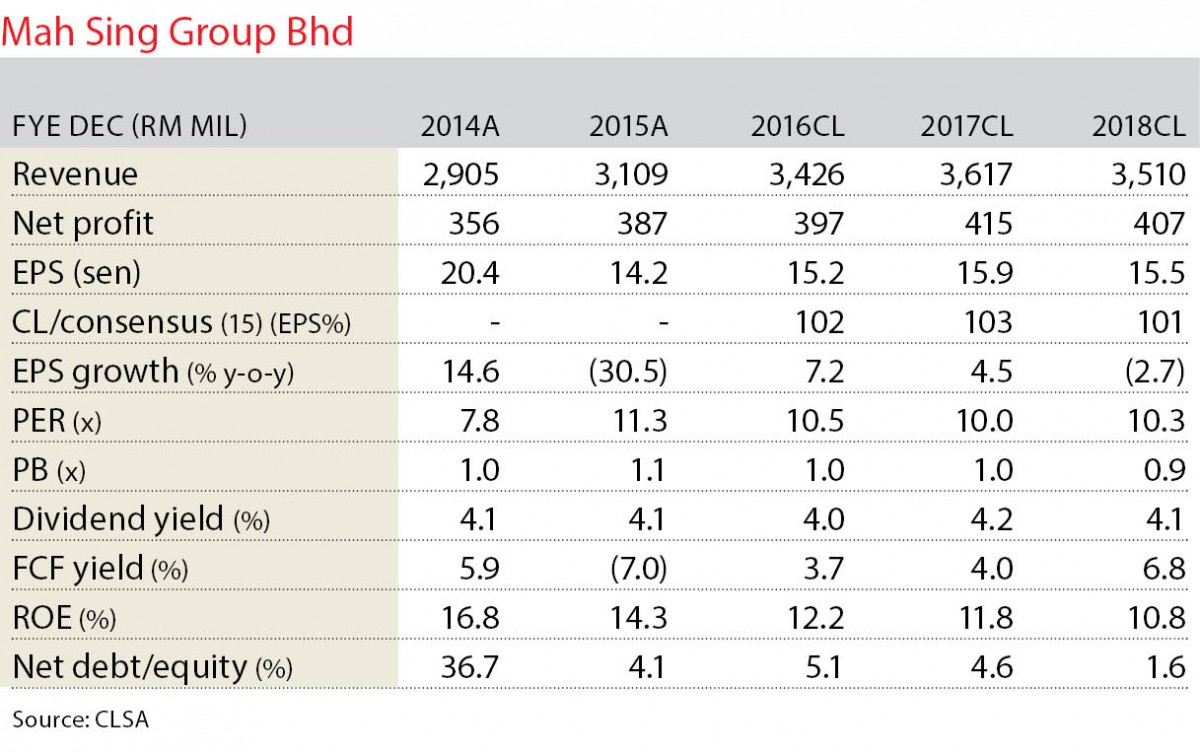

Upgrade to buy with a higher target price (TP) of RM1.90: Mah Sing Group Bhd is our top pick for the property sector that we believe is heading towards a positive inflection. We view the company as a high risk/reward Malaysia property pure play supported by a positive economic value added (EVA), low net gearing and decent yields driven by a clear sales strategy (central focus, easy entry). The stock’s current price-earnings ratio (PER) of 10 times 2017CL (32% discount to peers) further underpins our upgrade to “buy” (from underperform). Our target price is RM1.90 (was RM1.46).

Mah Sing’s strategy in facing the currently challenged property segment is twofold: focus on the resilient central region and offer easy entry to prospective buyers via attractive rebates. This has worked out well for the company thus far with decent take-up rates (more than 80%) for several of its projects. Its seven-month financial year ending Dec 31, 2016 (FY16) sales figure of RM1.03 billion came up short against its RM2.3 billion. We think it will be challenging to make up the deficit given the time constraint, hence forecast a conservative RM2.1 billion sales figure for FY16. Unbilled sales of RM4.8 billion as at FY15 should underpin earnings growth in 2016CL.

Mah Sing’s key project is the Southville City township located in Bangi, which makes up 36% of our estimated revised net asset value (RNAV). Our visit to the sales gallery over the weekend left us upbeat, with Cerrado Block A and B launched this financial year well taken up (100% each). Given its affordable pricing point (less than RM600,000 coupled with the attractive rebate (that is only RM3,500 down payment), we expect the strong take-up to persist for the upcoming Block C and D (75%) launches.

Net gearing for the company stood at 3%, which leaves ample room for landbanking, especially given the company’s internal ceiling of 50%. The repurchase of the convertible bond appears to be the right decision as it averted the potential 11% dilution effect. We do not expect the company to raise any more cash given the issuance of the perpetual sukuk in March 2015.

We have a “buy” call with an RNAV-derived TP of RM1.90 (-15% to our RNAV estimate). The stock currently trades at a 32% discount to peers in terms of 2017CL PER while providing above-market yields of 4.2% 2017CL PER, underpinned by positive free cash flow yield of 4% to 7% for FY16 to 2018CL. This is made more attractive given our expectations of a further 25-basis-point overnight policy rate cut in November 2016. — CLSA, Sept 14

Want to know the price trends of a development? Click here.

This article first appeared in The Edge Financial Daily, on Sept 19, 2016. Subscribe to The Edge Financial Daily here.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.