Take action against banks only if they don't lend to first-timers and buyers of affordable homes, says HBA

PETALING JAYA (April 27): Although the National House Buyers Association supports the move by the Ministry of Finance (MoF) to take action against banks who fail to give out housing loans to those eligible, the consumer body has proposed that action be taken only against banks that fail to lend to first-time homebuyers and those seeking to purchase affordable homes priced below RM300,000.

Finance Minister Lim Guan Eng, yesterday at the opening ceremony of HOC-MAPEX 2019 for the Klang Valley region in Kuala Lumpur told the Real Estate and Housing Developers' Association (Rehda) to supply the ministry with the list of rejected bank loan applicants and it will find out if the rejections were warranted.

Lim said that action will be taken against banks who “deliberately” do not give out housing loans to those who are eligible or fulfill the criteria.

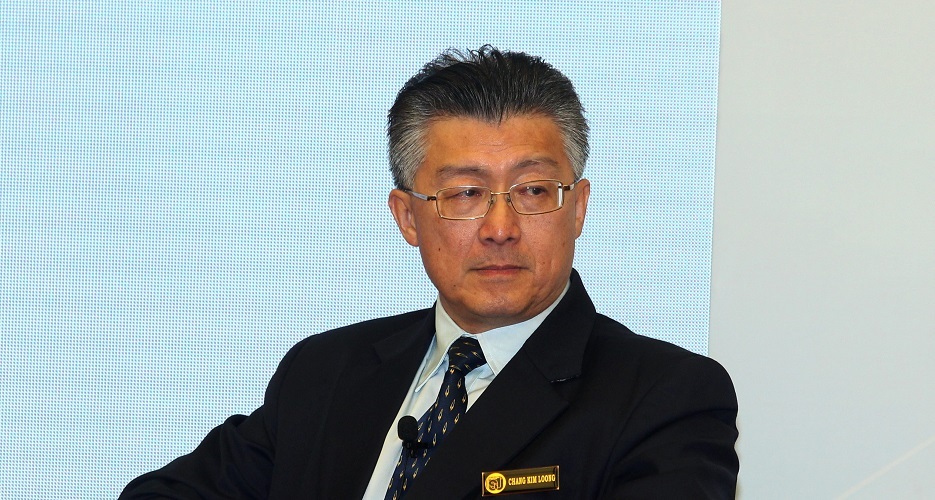

In a statement today, HBA secretary- general Datuk Chang Kim Loong said: "Due to the current high cost of living and stagnant wages, many first time house buyers find it very challenging to get a housing loan.

“However as time goes by, their salary is expected to increase and they will then be able to afford to buy the house that they are currently targeting.

“Unfortunately prices of property are always expected to increase at a higher rate than salary increments and after five years, the house buyer will not be able to afford the future market price for the current property that he or she is targeting.

“Hence, banks must be flexible and give some leeway when processing loans of first time house buyers by taking into consideration the future potential increase in salary, and structure a step-up housing loan whereby the house buyer is charged lower instalments, say for the first three years," he said.

Chang went on to say that this would be a win-win for homebuyers, who will get to buy their property; for developers who get to sell the property; for banks who get the customers and for the country at large as having a big percentage of the rakyat who is unable to buy their first home can bring many social problems.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.