Expanding Sime Darby Property’s boundary into real estate investment

Time: 6.35pm. Date: May 31, 2021

In just another 5.5 hours, Malaysia would be entering into Movement Control Order (MCO) 3.0 Phase 1. Unlike the eve of the first MCO on March 17 last year, neither disbelief nor optimism was hardly the order of the day.

The only certainty this time around is clear uncertainty in the days ahead.

“We had our meeting [today] with our crisis management team. The issue was to really try to make sense of the new rulings,” Datuk Azmir Merican tells EdgeProp Malaysia in a virtual interview slotted in between his packed schedule.

Azmir, group managing director of Sime Darby Property (SD Property), was referring to the conditions under which a developer could operate during the two-week nationwide lockdown announced late Sunday (May 30).

Whether or not the lockdown would be extended, enhanced or relaxed beyond June 14 would be anyone’s guess.

In the interim, strategic decisions need to be made. Processes must be put into place immediately, be it at the headquarters, work sites, offices or the sale galleries.

“We also have to look at the supporting infrastructure now that we work differently (remotely) – what we need and of course, what needs to happen,” adds Azmir.

Interestingly, Azmir, 50, took over the helm of SD Property just about 13 months ago, right smack during Malaysia’s first-ever pandemic lockdown.

“A year ago, we didn’t understand how long this (the pandemic) would last. You know, I think we were all kind of optimistic, and to be honest, we didn’t expect things to be how it is today.

“So that was a bit of a bummer. But there’s a big difference between the current MCO and the one in the past where we were totally shut down.”

From investment analyst to developer

Hard and painful lessons have been learnt in the last year. From totally shutting down the economy, the government has moved to tempering it alongside safeguarding lives and the country’s healthcare system – definitely a tough yet delicate task that could not please everyone all at the same time.

Despite the trying times which had come on the heels of an already challenging property landscape and the fact that Azmir was a newbie to the industry – he was the former managing director of UEM Edgenta Bhd – SD Property has turned in a strong report card.

Azmir started his career as an investment analyst and later, as a manager in the financial and corporate advisory arm of PricewaterhouseCoopers. He subsequently worked with CIMB Investment Bank before joining AWC Bhd as its group chief executive/managing director.

In 2012, Azmir joined the UEM Group as the group chief operating officer – business units, before taking the helm at UEM Edgenta where he led its ongoing transformation into a technology-based company, servicing the healthcare, property and infrastructure sectors.

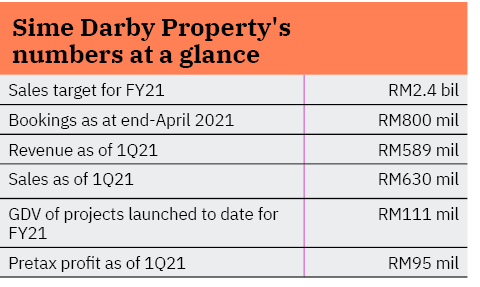

For FY 1Q2021, SD Property’s new property sales came in stronger at RM630.2 million (compared to RM344.6 million in 1Q2020) or 26% of its FY21 sales target of RM2.4 billion.

In a report dated May 27, CGS CIMB said SD Property had bookings of some RM800 million as at end-April 2021. As of March 2021, projects worth up to RM111 million (RM496.6 million in 1Q2020) in gross development value (GDV) were launched, which gained an impressive combined take-up rate of more than 90% upon launching.

Unbilled sales as at end-March 2021 stood at RM1.7 billion, higher than the RM1.5 billion a year ago. Another RM3 billion GDV worth of products are expected to be put on the market before the year is out.

On track to achieving RM2.4b sales

Azmir told the media at a briefing on May 27, SD Property was on track to achieving the FY2021 target of RM2.4 billion sales, pointing to what he called “agile launch plans with the right products being launched at the right time”.

One of the most anticipated upcoming launches is the Jendela Residences. This comprises 520 units in two blocks of luxury condominium within the prestigious Kuala Lumpur Golf and Country Club.

Will MCO 3.0 put a spanner in the works?

A realist, Azmir, does not discount this but is quick to add: “We are taking the approach to make sure that we will still preserve the numbers and keep the momentum”.

Clearly, under Azmir, over time, SD Property will no longer be just in the business of building homes, although this will remain the backbone of the company which has built more than 100,000 homes across two dozen townships.

From a pure property development company, Azmir is pushing the button for its transformation into a real estate investment company that is not totally reliant on property development.

Recurrent income is high on his to-do agenda. And this would not be limited to being a landlord but a focus on the industrial logistics sector, something he said would be revealed at an appropriate time.

One of SD Property’s current assets is the Melawati Mall at Bandar Melawati in KL.

Meanwhile, Azmir has already identified RM100 million worth of SD Property’s non-core landbank to be sold via tender in a very transparent manner.

“What we’re looking at is to build a recurring income model. And if you look at companies all over the world, there are so many ways to build a recurring income model.

“In five years or sooner, we hope to achieve a contribution ratio of 70:30 property development and non-property development respectively,” reveals Azmir.

The pandemic has also accelerated the digitisation process of SD Property, an area that Azmir is clearly very comfortable with.

“Today, we need information on a real-time basis. What we’re trying to do in SD Property is to pull all this information, put it in the cloud, and we can pull the data back for analysis,” he elaborates.

Conservation and sustainability

Why would a self-professed conservationist be in a business that cuts down trees then?

Azmir laughed!

“It wasn’t a natural decision to take this role in the property development sector.

“It was something that I had trouble with. To be honest, I couldn’t get on with it. When I was with the UEM Group, I told Anwar Syahrin (managing director/CEO of UEM Sunrise from 2014 to 2020) that this was something I would never do. But then again, never say never.

“What I think appeals to me at SD Property is that the sustainability effort is second to none. And it’s real. And when I talked to the then (SD Property) chairman Tan Sri Zeti [Akhtar Aziz] and the Board, I think it was very clear that the environment was very important to me. In whatever I do next, it is not about me going somewhere and earning a paycheck. It is about really doing something good,” Azmir shares enthusiastically.

This year, SD Property was inducted into Malaysia Developers’ Hall of Fame. The exclusive membership is not for sale. It is only accorded to Malaysia’s developers who have been awarded the EdgeProp Malaysia’s Responsible Developer: Building Sustainable Development Award which SD Property was awarded for this year.

Meanwhile, its Elmina Central Park was crowned a Gold winner of the EdgeProp-ILAM Malaysia’s Sustainable Landscape Awards in the Landscape Planning category. In addition, the park also bagged the EdgeProp Malaysia’s Editor’s Choice Awards as Malaysia’s Exemplary Sustainable Community Park 2021.

What does SD Property’s sustainability journey mean for buyers? Azmir does not deny that building homes that are sustainable in the true sense of the word might cost, perhaps, 2-3 % more. However, the team is exploring innovative solutions that could counter this.

“For example, if you could have a system in your house that could generate 50% of your electricity [consumption], that’s something interesting. If you could package that with funding, where the savings would be partly paid in the long-term payback period, that might work, I am not sure. I don’t have a good answer, to be honest. And you’ll be disappointed. But I think we have not thought about it enough, at least for me, to come up with really innovative solutions. So, we really need to do better,” Azmir admits.

It is refreshing to hear a CEO confess he needs to think more and do better.

So, what is Azmir’s game plan for SD Property? Can he pull it off? Especially in the face of the pandemic uncertainty? Below is an excerpt (edited for clarity) of EdgeProp Malaysia’s interview with Azmir.

Impact of MCO 3.0

EdgeProp: What does this mean for your FY2021’s RM2.4 billion sales target?

Azmir: It’s too early for us to say anything for now. Of course we want to keep it at that number but we are also not going to be unrealistic to say that this lockdown will not have an impact. What we’re trying to do is to make sure we still preserve the number and keep the momentum going. The idea is to ensure that we can monitor all the way down – on the ground, where and what are the things happening.

EdgeProp: For SD Property, how is MCO 3.0 vs MCO 1.0?

Azmir: We had our meeting today (May 31) with our crisis management team. The issue was to really try to make sense of the new rulings. So, we had all the areas on what we will do at the HQ, at our sites, the offices, at the sales galleries and at the construction sites. We also have to look at the supporting infrastructures now that we work differently – what kind of supporting infrastructure we need, and of course, what needs to happen.

The supporting infrastructure is to serve this new arrangement, so the process will have to change to serve different kinds of data. I think we have got clarity now – subject to confirmation – if we have a Centralised Labour Quarters, then we can continue work at 60% capacity. So, we’re just waiting for that to be confirmed. Then we are getting our subcontractors to apply to the Construction Industry Development Board for the approval.

EdgeProp: Is SD Property better prepared for the MCO this time around?

Azmir: I believe so. I think not just SD Property, but all of us are more used to this. It takes a bit of getting used to and having the right infrastructure in. There are two parts – the first one is more operational, which is to make sure the day-to-day function can be effective. The other one is in preserving and protecting our P&L (profit and loss), which is making sure that we are monitoring the right numbers. Where can we generate revenue? And where can we generate sales? These two things are important for us. So, how do we do this?

We want to ensure that our property launches are done in an effective manner. You do want to communicate and be very clear to the buyers, telling them what is going to happen.

There’s a big difference between the current MCO and the one in the past when we were totally shut down.

Compared to a year ago, our digital channels are much better today. Our infrastructure is much better, our people are more equipped to sell, and can communicate with clients without having them walk into the sales gallery.

We are also trying to see how we will work with banks to get the homebuyers to sign the loan documents because we know for the sale and purchase agreement, there is no issue. If we overcome this, we have definitely progressed from where we were one year ago.

EdgeProp: Is there still demand from buyers?

Azmir: For SD Property, we still have a lot of confidence that the products we are launching will do well. Why do I say this? Last year, we took time to revisit all our launches, to look at what kind of products would sell. If you look at this year’s launches, they’ve done very well. Basically, based on the last two, our launches are above the 90% take-up rate.

(Read: Units of Dayana Nilai Impian Phase 1 fully taken up)

Upcoming is the launch of our luxury condominium Jendela Residences. We also have some upcoming launches in City of Elmina and Serenia City. These would be similar in pricing to the earlier launches that have done well. So, we know that we can still do well.

EdgeProp: For Jendela Residences, the sizeable 520 units are priced from RM1,200 psf. Why are you confident that it will do well?

Azmir: A couple of reasons. One is the amount of market research that has gone into it. Two, I’m confident because of the location factor and the clientele that we have. We have done some previews from which we could see a lot of demand. The price tag is not a deterrent for the potential buyers at all.

Bookkeeping its assets

EdgeProp: Are there any plans to dispose of any of your landbanks to meet the numbers for this year?

Azmir: We have about 100 million worth of non-core land which will be tendered out this year. The process is going to be open and transparent; we will appoint a third party to do it. We don’t think the [disposal of asset] will be recognised this year, maybe at most one or two [will be recognised this year].

These are small-sized landbanks such as those meant for petrol stations in different parts of the country, which we will not be developing. Maybe someone else can do it better. Land is an asset and it needs to generate returns.

Pure property developer no more?

EdgeProp: We understand that SD Property has plans to move away from just being a pure-play property developer. Share with us your plans.

Azmir: It’d be early for me to talk or to go into a lot of details, but essentially, what we’re looking at is to build a recurring income model. And if you look at companies all over the world, there are so many ways to build a recurring income model. For us, we also look at the archetypes of property companies in Malaysia, Singapore, regionally and all over the world. What sort of archetypes do you have? What’s been the evolution of property development companies?

I clearly see that we just can’t depend on being a pure-play. For SD Property, we want to evolve to what we call a total real estate development company, with recurring income.

There are some plans – we are exploring how to do more of the industrial logistics business. We see Bandar Bukit Raja as an excellent area where we can monetise recurring income better. There are several ways to do that – we are exploring now how we can work with other partners. It’s nothing spectacular, but it’s something that SD Property has to learn.

EdgeProp: Property development is the biggest contributor to SD Property’s revenue. What is the ratio of development vs recurring income you would be happy with five years from now?

Azmir: We would be happy if we hit a 70:30 (30% non-property development). Currently it is 93:7. If it is sooner, it is even better.

EdgeProp: What about the product types you are building?

Azmir: We also have to evolve. We are looking at building more integrated and high-rise products because we need to have better utilisation of the land. As our townships mature, we have to go vertical. We are also looking into industrial properties, so that’s going to be quite a big focus. Even this year, we are going to launch an industrial park which is about 400 acres.

It is about getting the right sort of competency and the right inputs and working with the right people. And having the safeguards before we press the button to go. The safeguards buy us some insurance. Well, from what I’ve seen is making sure we do a lot of homework.

EdgeProp: But wouldn’t that be the case with every developer?

Azmir: I suppose so. I don’t know how they work, to be quite honest, but I get a lot of input from the Board and there are good people on our team. I can’t say too much, I’m still cutting my teeth in property development (chuckles).

On extension of the Home Ownership Campaign to end-2021

Azmir: We are very thankful the government is hearing what the property developers are saying. This will help, so that we can sustain our momentum. And, of course we will be capitalising on it.

Buying homes online catching on?

EdgeProp: Do you think Malaysians are ready to buy a home online?

Azmir: There are products that people are comfortable buying online but maybe buying a house is not one of them. But I do think that having a [good] reputation in SD Property will help us bridge some of that gap. Because people are not unfamiliar with our products. You know, if we have really good online showrooms, it’s enough to get somebody to say: Hey, I like this product and I’m going to call somebody to find out a bit more. Then we can send more information and we can talk. I think we have to go that way.

As for digitisation, it is disrupting how property developers operate. Today, we need information on a real-time basis. What we’re trying to do in SD Property is to pull all this information to put it in the cloud, and we can pull the data back for analysis. This is something I’ve done before when I was in UEM Edgenta, and we are doing it here so that we can analyse buying patterns because people are booking online. You can actually see how the units are being taken up.

We are working on a collaborative platform where everybody is working on a single project management solution, so that we can capture all the data.

Of conservationism and property development

EdgeProp: As a self-professed nature lover, you are now cutting down trees …

Azmir: It wasn’t a natural decision. It was something that I had trouble with, to be honest, I couldn’t get on with it. When I was with the UEM Group, I told Anwar Syahrin (managing director/CEO of UEM Sunrise from 2014 to 2020) that this was something I would never do. But then again, never say never.

What I think appeals to me at SD Property is that I think our sustainability effort is second to none, and it’s real. And when I talked to the then chairman Tan Sri Zeti [Akhtar Aziz] and the Board, I think it was very clear that the environment was very important to me. In whatever I do next, it is not about me going somewhere and earning a paycheck, it is about really doing something good.

And it is really high time that the company has a social purpose. Otherwise, we become like any other company, and any other company is boring. I think in the future, people don’t work just to make money, they work for a cause.

And it sets us apart because people want to work at SD property because of the things we do. That’s what we’re trying to do in SD Property. We’ve got to be true to ourselves – take the time to see – how we take an industry which is cutting down trees to at least being carbon negative.

EdgeProp: What does SD Property’s sustainability journey mean for property buyers?

Azmir: For us to reduce carbon footprint, there’s a couple of ways we can do it. But, more importantly, what is the future property buyer expecting? And all the things that we’re doing, are they going to matter or not?

I’ll be honest, this is all WIP (work in progress). We can plant so many trees and this is the simplest way to work on it but it’s not real, because we’ve got to look at our actual process of doing things. And then we’ve got to tell the buyers this is how we build our houses. Just like safety, you know, sustainability also will come at a price.

So, the thing to do is to make sure the price will have a value to it. This means homeowners will be willing to pay for maybe slightly more knowing they are getting better quality products and they are minimising the carbon footprint as well.

For example, we are looking at installing batteries in homes so that homes are greener. So, today you install solar but you cannot use the electricity because you know, you can’t store them. We’re working with one or two parties to see if we can store energy. We are also working with a few other bodies to see what else we can do. I think that one has a direct impact on the buyer.

EdgeProp: For homebuyers, ultimately it boils down to how much I need to pay, hence the scepticism. How is SD Property planning to overcome that kind of perception?

Azmir: We build a certain product and we deliver it. This product is probably not for everyone today. But I think more and more people feel that this is important. The test is whether they will pay for it. Maybe 2-3% more, I think they wouldn’t mind paying for it, but if it were 5-10% more, they wouldn’t pay.

There are other solutions. For example, if you could have a system in your house that could generate 50% of your electricity [consumption], that’s something interesting. If you could package that with funding, where the savings would be partly paid in the long-term payback period, that may work, I am not sure.

I don’t have a good answer, to be honest. And you’ll be disappointed. But I think we have not thought about it enough, at least for me, to come up with really innovative solutions. So, we really need to do better.

EdgeProp: It’s been slightly past the one-year mark since you’ve been at the helm of SD Property. Has anything caught you by surprise?

Azmir: Probably, a year ago, we didn’t understand how long this (pandemic) would last? You know, I think we were all kind of optimistic, and, to be honest, I didn’t expect things to be how it is today – that is a bit of a bummer.

I think, other than that, the team has been quite good. As a new group managing director, the limitation is that – you need to build trust with your team. And sometimes that means sitting down with people, and that’s also over and above just work – having a meal, discussing things together. So, the core team will, at some point, become quite intuitive towards one another.

We know what we are all thinking, and I think this process will take a bit of a longer time. Maybe I’m not learning as fast (chuckles).

It is a small thing but I like to go to the ground. I’m probably not able to do that as much, so there’s some frustrations there. But generally, I think we just want to make sure that we manage things well and that people are okay, so we can come out of this together.

This story first appeared in the EdgeProp.my E-weekly on June 4, 2021. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.