Why are borrowers made to pay for bank template documents?

It has been a common practice for banks to impose fees for standardised loan agreement documents that are needed in the housing loan application process.

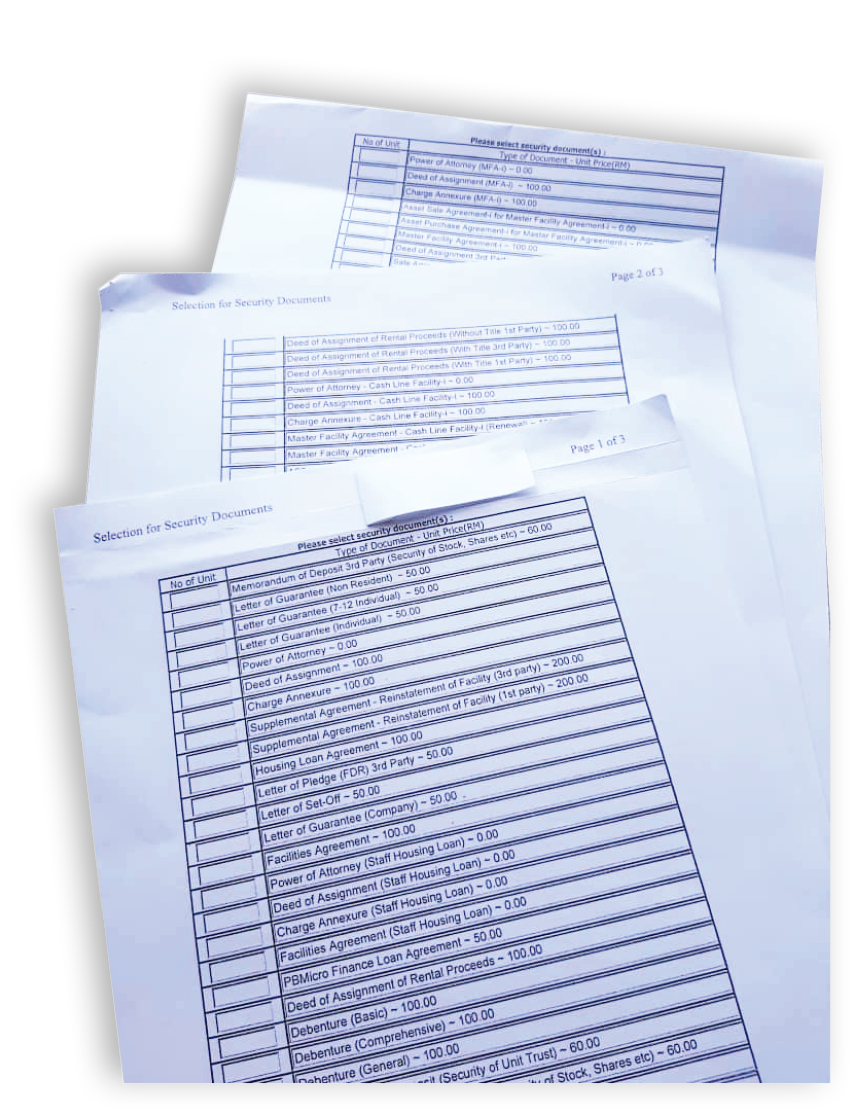

Law firms have to purchase these standardised pre-printed forms, or typically download the documents from the banks’ portals for prices ranging from RM100 to RM500, or sometimes even higher.

Such expenses are, of course, passed down to customers or borrowers as disbursements, usually under the column “purchase of bank’s printed forms”.

The Bar Council of Malaysia has raised its concern over this added burden for consumers, which they can certainly do without.

In 2019, the press published a statement by Bar Council conveyancing practice committee (immediate past) chairman Datuk Roger Tan who cautioned against imposing such fees as the sale of loan documents was a breach of Section 37(2) of the Legal Profession Act 1976.

The National House Buyers Association (HBA) concurs with the press statement. In fact, we have on Oct 3, 2019 reported on this dilemma but it seems our pleas have fallen on deaf ears.

Even before that, we had in 2013 written several articles on related issues such as in “Simplified housing loan agreement” as well as HBA’s stand against banks’ practice in selling the standardised loan documents.

Read also

Are borrowers still at the losing end of loan agreements?

Can’t a soft copy be made available to law firms to adopt and print at their own costs and expenses? After all, printing charges are only limited to RM50, as approved by the Bar Council.

Banks insist on right to charge fees

In our recent meeting with Pemudah (Special Task Force on Facilitating Business)’s Technical Working Group on Getting Credit (TWGGC) initiated by Malaysia Productivity Corp (MPC) on April 28, 2021, HBA reiterated our stand on this issue.

The meeting was chaired by Datuk Pardip Kumar Kukreja. Attendees included members from the Association of Banks in Malaysia (ABM), Association of Islamic Banking & Financial Institution (AIBIM), Malaysian Bar Council, Real Estate & Housing Developers’ Association (REHDA) and Bank Negara Malaysia (BNM).

Tan, who was a senior Bar Council member then, repeatedly emphasised that it was an offence under section 37(2) of the Legal Profession Act, 1976 for any unauthorised person, who either directly or indirectly drew or prepared any document or instrument relating to any immoveable property, to expect any fee, gain or reward.

The bankers insisted that banks were not prohibited from charging “fees” on standard loan documents as there were no regulations against it. They even emphasised that BNM did not have power over the Competition Act, 2010, which they used in their defence. (HBA is of the opinion that the Competition Act has got nothing to do with the sale of printed forms.)

BNM stood by the bankers and even clarified that banks did not sell the standard forms per se but the fees levied reflected the actual costs incurred in “developing standardised loan documents”, as there was manpower involved in reviewing the documents and thus, the cost was recovered via the fees.

Our contention is, this fee for a standard form has been charged since 2013. Surely, such costs must have been amortised over the years. Must the banks continue to profit from the sale of forms? Isn’t their major source of income derived from giving out loans?

Contrary to BNM’s assertion that the banks were not “selling” the forms, isn’t the act of charging a fee equal to selling?

The banking sector in Malaysia is a very tightly regulated industry. Any fees that banks intend to charge must be approved by BNM. It is disheartening to note that borrowers continue to be charged exorbitant fees even under the watchful eyes of BNM. Instances of borrowers being charged unreasonable fees for copies of redemption statements, EPF statements, letters, etc are common.

BNM’s policies have always been in line with the Government’s aspirations especially when it comes to allocating funds for promoting the affordable housing category. Then why do buyers of even affordable housing still have to bear the “fees”?

BNM should crack its whip

In addressing the concerns over mortgage agreements which are disproportionately skewed towards banking institutions, BNM has on Nov 6, 2019 come up with a policy document titled “Fair Treatment of Financial Consumers” (FTFC). It outlines how banks should be responsive to the needs of financial consumers and to conduct their businesses in a way which engenders trust and confidence leading to high customer satisfaction and retention and hence, leading to sustained business performances over the long term.

Appendix 1 to the FTFC policy statement states inter-alia:

Sub-para (d): does not impose excessive or unreasonable fees and charges that do not reflect the actual costs incurred in the provision of services offered or which significantly disadvantage certain groups of financial consumers.

However, have those policy statements been translated to actual and factual adherence? Has BNM conducted its annual audit check on banks including compliance and adherence of the newly minted “consumer-friendly policies”? Has BNM, or at the least with the assistance of ABM and AIBIM, identified the “good” versus “poor” practices to arrive at “fair” practices?

Surely, BNM cannot be waiting for the Federal Court to intervene again before it decides to act on it just like in the case of the British borrower Anthony Lawrence Bourke and wife who succeeded in declaring that it was unconscionable for banks to seek refuge behind exclusion clauses.

Read also

Are borrowers still at the losing end of loan agreements?

BNM must lead and spare a thought for the borrowers and law firms who are often at the mercy of this unequal bargaining with the banks. BNM has a comprehensive legal power to regulate, supervise and monitor all participating financial systems and to crack its whip against any unscrupulousness.

Similarly, the Ministry of Finance, ABM and AIBIM have a legitimate interest in the final shape of the banking industry as being one that is principled and “customer- friendly” and we sincerely hope banks heed the call.

Datuk Chang Kim Loong is the Hon Secretary-general of the National House Buyers Association (HBA).

HBA can be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

This story first appeared in the EdgeProp.my E-weekly on June 25, 2021. You can access back issues here.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.