Find out why your home loan application is rejected

You’ve done your property window shopping – visiting sales galleries and even walking around some neighbourhoods to get a feel of the surroundings you wish to make your forever home.

When you have found it, your property agent helps you to apply for your housing loan. Days later, your agent informs you your application has been rejected by the bank.

You start to wonder why.

This is a common scenario among homebuyers. Let’s find out what the possible reasons are so you can increase your chances of success on your next applications. One thing for sure, your salary is not the only thing that determines your eligibility.

Here are some of the contributing factors:

Debt Servicing Ratio (DSR)

DSR is a formula banks use to determine whether you are able to pay back the loan you are applying for. They measure your affordability according to the commitments you have against your income. These commitments include your monthly obligations such as loans, bills, etc.

DSR = [Commitment/Income] x 100

Some banks will take into account your gross monthly income while some will only consider your net monthly income. For net pay, it is after the deduction of your EPF and Socso contributions and such.

Once you have got the figure, you can gauge what your position is like. Usually, the banks’ acceptable rate for lenders is around 65% to 70%.

Risk profile

Most of the time, banks refer to your credit score to assess whether your financial track record is healthy. You can find out how healthy your own credit score is through CCRIS and CTOS.

For CCRIS, you can request for a copy of your report from the Bank Negara Malaysia (BNM) Head Office or regional offices through mail, email, fax or online via eCCRIS service. However, you will need to register in person at any BNM branch before using it. After that, you can access it anytime you like.

On the other hand, your CTOS report is easily accessible online.

Besides the credit score, banks will also check if you pay your bills and loans on time. On this aspect, it is actually a disadvantage if you do not have any other borrowings. It will show up as red flags for banks as they are unable to gauge what your repayment habits are like. Therefore, it is advisable to at least have a credit card to start building your credit reports.

Joint borrower

If you are unable to afford a home loan by yourself, it is a good idea to get another family member to share the responsibility of repaying the loan. This may help increase your chances of getting your loan approved, but bear in mind that the banks will also assess the credibility of your joint-borrower.

Besides that, they will also assess the relationship between the main applicant and the co-applicant, even weighing the possibility of fallouts in the relationship. The three types of joint borrowers are married couples, siblings and friends. How strong the bond and trust are between the joint borrowers matters to the bank.

Stable income

It is no secret fixed income earners have better chances of getting their loans approved as they can better evaluate the consistency of the applicant in servicing the loan compared to those with no fixed income.

For those who are self-employed, here are few measures you can take to increase your loan application approval:

- Maintain organised financial records

- Open a current account

- Make consistent EPF contributions

- Get a guarantor with a strong financial background

- Maintain a healthy credit history

Good track record

Lastly, how is your relationship with the banks? Make sure you do these to avoid being blacklisted by any bank:

- Pay all your bills on time.

- Ensure your credits are within reasonable limits. Avoid applying for multiple credit cards and do not spend beyond your means.

Do your due diligence

You can use EdgeProp.my’s LoanCheck at https://www.edgeprop.my/loancheck to find out the maximum amount you can borrow before you go house hunting.

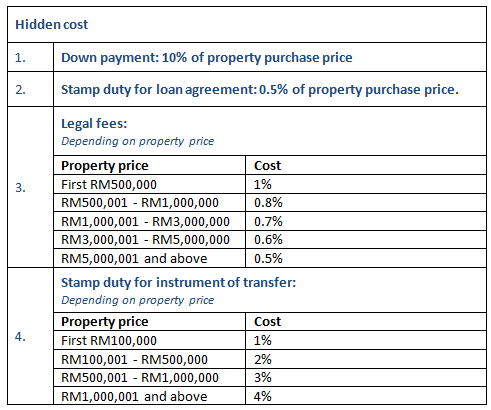

Other than that, be prepared with enough money to pay for hidden costs such as down payment, valuation fees, documentation fees, legal fees and stamp duties on the housing loan.

Some banks can provide an additional margin of up to 5% for insurance coverage on your loans such as Mortgage Reducing Term Assurance (MRTA) or Mortgage Level Term Assurance (MLTA), and 2% for legal fees to help finance your valuation and documentation costs.

To get an idea of how much these will cost, here is a standard guide:

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.